Page Contents

TogglePartnership Firm Registration In India

If you’re planning to establish a business with two or more individuals, Tax2Fin can facilitate a seamless Partnership Firm Registration Process in India. Our team will manage all compliance aspects, clarify the benefits of forming a Partnership Firm, and provide transparent information regarding the registration fees, ensuring a trouble-free setup for your venture.

Get Free Consultation by Expert

What is Partnership Registration?

A Partnership Firm is a widely adopted business structure globally, particularly favored by small and medium-sized enterprises. It offers a middle ground between a sole proprietorship and a corporation, uniting individuals who share a common business objective. This overview explores the definition, formation, characteristics, types, advantages, and legal aspects of a partnership firm.

Essentially, a partnership firm is a business entity created by mutual agreement among a group of individuals, known as partners, who decide to conduct a business together and collectively share its profits and losses. The process of forming a partnership typically begins with a partnership agreement or deed. This crucial document outlines the agreed-upon terms and conditions, such as capital contributions, profit-sharing ratios, individual roles and responsibilities, methods for resolving disputes, and procedures for dissolving the partnership. For those looking to formalize their business, Partnership Firm Registration in India is essential to ensure legal recognition and compliance with local regulations.

A defining characteristic of a partnership firm is that it lacks a separate legal identity from its partners. This implies that the partners bear unlimited personal liability for the firm’s debts and obligations. Furthermore, a partnership has a limited lifespan; it can be dissolved upon the death, bankruptcy, or withdrawal of a partner, unless the partnership agreement specifies alternative provisions.

Tax2Fin ensures high client satisfaction and swift delivery of your Partnership Firm Registration Certificate. Our expert team efficiently handles all government requirements. For effective Partnership Firm Registration in India and thorough compliance services, please contact us.

Partnership Firm Registration Process

Choose a Firm Name

Begin by selecting a unique name for your partnership firm. Ensure this name doesn't infringe on existing trademarks and isn't too similar to other businesses, particularly within your industry, to avoid confusion and legal issues.

Draft a Partnership Deed

The partnership deed is the most vital element in the entire Partnership Firm Registration Process. This document is a written agreement among the partners, detailing the terms and conditions governing their collaboration. It typically specifies the firm's and partners' names and addresses, the nature and location of the business, and each partner's capital contribution. Additionally, it defines the profit-sharing ratio, outlines the duties and powers of each partner, and sets forth rules for admitting, retiring, or expelling partners. The deed also includes procedures for dissolution and mechanisms for resolving disputes.

Notarize the Partnership Deed

Once the partnership deed is drafted, it must be executed on stamp paper of the appropriate value as mandated by the relevant State Stamp Act. All partners must sign it, and subsequently, the deed needs to be notarized by a public notary to give it legal validity.

Register the Firm (Optional but Recommended)

Should you choose to register your firm, you must submit an application to the Registrar of Firms in the state where your business operates. This application needs to include Form 1, which is the official registration form, along with a duly filled Specimen of Affidavit. You'll also need a certified original copy of the Partnership Deed, proof of the principal place of business (such as a lease or rental agreement), and the PAN card and address proof for all partners. Finally, the necessary government fees for partnership firm registration must be paid.

Obtain PAN and TAN for the Firm

You will need to apply for a Permanent Account Number (PAN) specifically for the partnership firm. Additionally, if the firm is liable to deduct tax at source (TDS), you must also apply for a Tax Deduction and Collection Account Number (TAN).

Open a Bank Account

After the firm is registered, open a current bank account in the name of the partnership firm. For this, the bank will require the partnership deed, the firm's PAN, and other KYC documents of all the partners. This separation of business and personal finances is crucial for proper accounting and financial management.

Obtain Other Necessary Licenses and Registrations

Depending on your business activities, additional registrations might be necessary. GST Registration is mandatory if your firm's turnover surpasses the specified threshold or if it conducts inter-state supply. Obtaining an Udyog Aadhaar/MSME registration for the Partnership firm is a straightforward process that can be completed online. Similarly, acquiring a Business Registration Number (BRN) for the Partnership firm is also a simple online procedure. Furthermore, based on your business type, you might require other specific licenses, such as an FSSAI license for food-related businesses or an IEC for import-export activities.

Documents Required for Partnership Firm Registration

Director and Shareholder PAN Cards

For all proposed Directors, you'll need their PAN Card. For all Indian Shareholders and Directors, both their PAN and Aadhaar Cards are required.

Business Address Verification

If the business property is owned, provide a copy of the Registry and the latest government electricity bill. If the property is rented, you'll need the Rent Agreement, the latest government electricity bill, and a No-Objection Certificate (NOC) from the landlord.

Additional Director Documents

Each proposed Director must submit a utility bill, telephone bill, mobile bill, or bank statement that is no older than two months as proof of address. You'll also need their mail ID and mobile number, along with the Draft Articles of Association and Draft Memorandum of Association.

Photographs and ID

Finally, you'll need latest passport-sized photographs of all proposed Directors, along with their Aadhaar Card or Passport for identification.

Mail ID and Mobile number

Mail ID and Mobile number of proposed Director along with Draft Articles of Association and Draft Memorandum of Association.

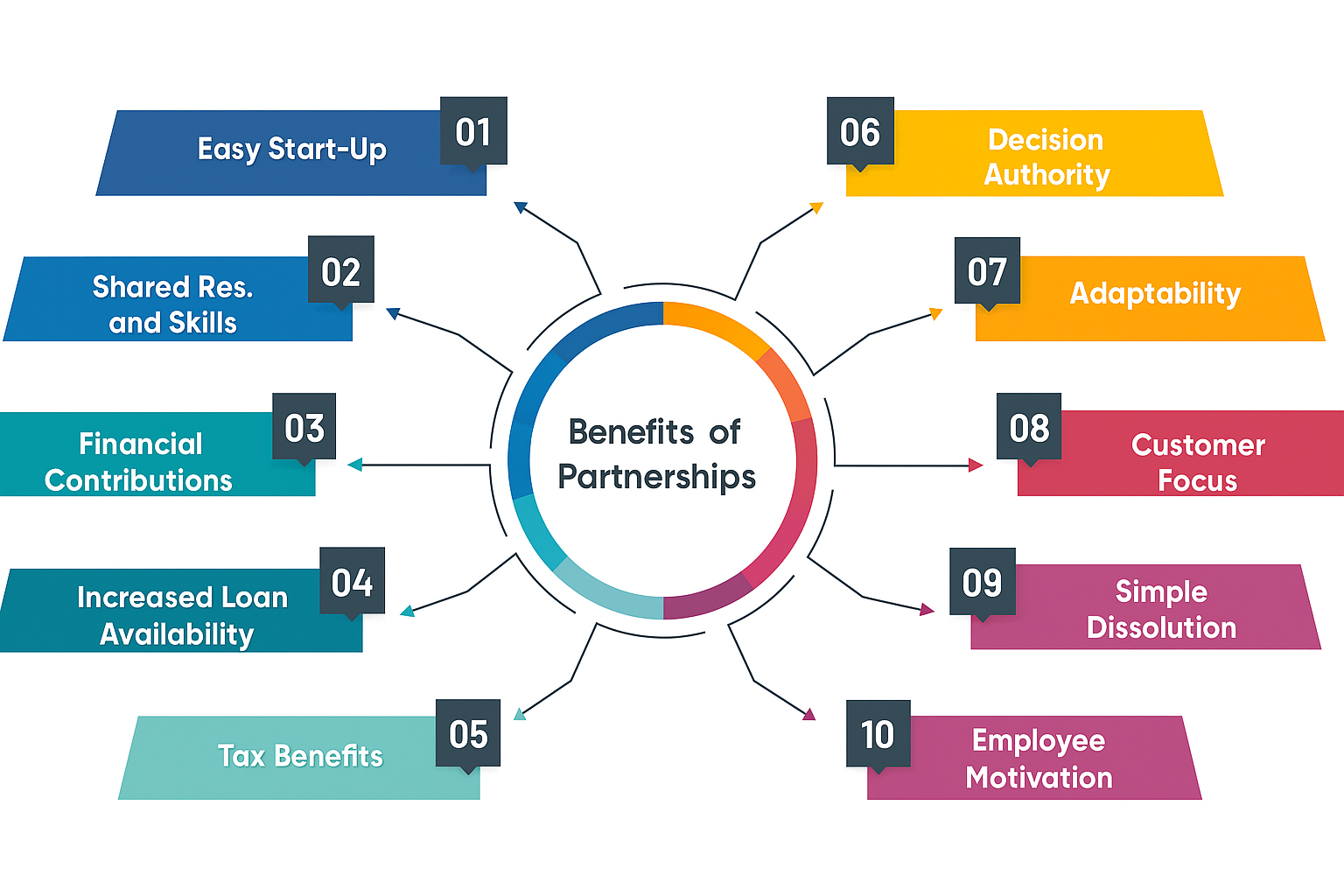

Advantages of Partnership Firm Registration

Easy to Establish and Operate

Setting up a partnership firm is generally simpler and involves fewer legal formalities compared to corporations. The registration process is less complex, making it a convenient option for many entrepreneurs. This ease extends to the ongoing management and operational aspects, which are typically less demanding.

Combined Resources and Expertise

A significant benefit of a partnership is the ability for each partner to bring different skills, expertise, and resources to the business. This diverse pool of talent can lead to more effective decision-making, improved problem-solving, and access to a wider range of networks and capabilities, which are crucial for business growth.

Shared Financial Commitment

The financial responsibility of initiating and operating the business is distributed among the partners. This reduces individual financial risk and can simplify the process of securing necessary funding, as each partner can contribute capital.

Greater Borrowing Capacity

With multiple owners, a partnership often possesses a stronger overall financial foundation. This enhanced financial standing can make it easier for the firm to secure loans and credit from financial institutions, which is advantageous for business expansion or managing operational expenses.

Tax Benefits

A key advantage is the pass-through taxation treatment. Business income is directly passed through to the partners, who then report their share of profits or losses on their individual income tax returns. This structure effectively avoids the double taxation issue often encountered by corporations, where profits are taxed at both the corporate and individual levels.

Decision Making and Control

Partnerships facilitate shared decision-making and management. All partners typically have equal rights in the firm's management, leading to a more collaborative and democratic approach to important business decisions.

Flexibility

A partnership firm offers considerable operational flexibility. Decisions can be made swiftly without the need for extensive procedures and protocols often required in larger corporate structures, allowing for quick adaptation to market changes.

Personal Service

Due to the close involvement of partners, partnership firms often excel at providing personalized customer service. This direct engagement can foster stronger customer relationships and loyalty, which is particularly valuable in service-oriented businesses. For those considering such an venture, Partnership firm registration can help establish this structure effectively.

Ease of Dissolution

Compared to a corporation, dissolving a partnership is typically a more straightforward process. If partners decide to cease business operations, the legal procedures involved are generally less complex and less costly.

Incentive for Employees

Partnership structures can offer a powerful incentive for attracting and retaining top talent by providing employees with the potential opportunity to eventually become a partner themselves. This can motivate employees and foster a strong sense of ownership.

For expert LLP company registration in India, contact Tax2Fin to get assistance throughout the LLP registration process.

How Tax2Fin helps you in the Partnership Firm Registration Process?

We are committed to providing comprehensive support to our clients throughout the partnership firm registration process in India. You will be assigned a dedicated personal manager who will guide you through every step, ensuring all necessary registrations are completed efficiently and that partnership firm registration fees are handled transparently. This seamless experience is contingent on the timely provision of required documents and information from your side.

Steps to be taken care of Post Partnership Firm Registration in India

Open a Bank Account

Once your partnership firm is officially established, immediately open a current bank account in its name. This separation of business and personal finances is crucial for clear accounting and financial transparency. You will typically need the partnership deed, the firm's PAN card, and other relevant KYC documents for the partners to complete this process.

Obtain Necessary Licenses and Registrations

Beyond initial setup, several other registrations might be required. You'll need to consider GST Registration if your firm's turnover crosses the specified threshold or if it engages in inter-state supply. Depending on state regulations, Professional Tax Registration may also be necessary. If your firm operates from a physical premise, a Shop and Establishment License might be required according to state laws. Lastly, various other business-specific licenses could be mandatory depending on your industry, such as an FSSAI license for food-related businesses or an IEC for export-import activities.

Tax Compliance

For tax purposes, the firm must complete its annual income tax filings. Since partnerships are considered "pass-through" entities for taxation, each partner is also responsible for reporting their portion of the firm's profit or loss on their individual income tax returns. Additionally, the firm needs to ensure compliance with TDS (Tax Deducted at Source) regulations if applicable.

Maintain Financial Records

It's crucial to maintain accurate and up-to-date accounts through regular bookkeeping. This practice is essential for tracking expenses, understanding financial trends, and fulfilling tax obligations. Furthermore, depending on factors like turnover and other specified criteria, the firm's accounts may require an annual audit by a qualified chartered accountant.

Comply with Legal Requirements

It is important to regularly review and update the partnership deed, making amendments as needed. This is particularly crucial if there are changes to partnership terms, capital contributions, or profit-sharing ratios. Furthermore, the firm must ensure all its operations comply with the provisions of the Indian Partnership Act, 1932, or any other relevant legislation in your jurisdiction.

Manage Partnerships Effectively

It is important to hold regular meetings among partners to discuss the business's progress, strategies, and any emerging issues. Additionally, clear protocols should be established for resolving any disputes that may arise between partners.

Insurances and Risk Management

Consider implementing risk management strategies through appropriate insurance policies, Obtain relevant insurance policies such as commercial general liability insurance, property insurance, and potentially professional liability insurance, to protect the business from unforeseen risks and financial losses.

Statutory Reporting

While partnerships don't have the same extensive statutory annual reporting requirements as companies (e.g., filings with the Ministry of Corporate Affairs), it is considered good practice to prepare internal annual reports that detail the firm's financial performance and operational highlights for informed decision-making.

Handling Changes in Partnership

Follow proper legal procedures, as stipulated in your partnership deed and relevant laws, when admitting new partners or when existing partners exit the firm (due to retirement, death, or withdrawal).

Marketing and Business Development

Continuously develop and implement strategies for marketing and promoting your firm. This is essential for attracting new clients or customers, expanding your market reach, and ensuring sustained business growth.

FAQs

What is a Partnership Firm?

A Partnership Firm is a business structure created when two or more individuals agree to jointly manage and operate a business. Their operations are guided by a Partnership Deed, and they collectively share the profits, risks, and liabilities of the venture.

How is a Partnership Firm formed?

A Partnership Firm is established through an agreement among its partners, typically documented in a Partnership Deed. This deed outlines crucial terms such as how profits will be shared, each partner’s capital contribution, and their respective management responsibilities within the business.

Is registering a Partnership Firm mandatory in India?

In India, the registration of a Partnership Firm is not legally compulsory. However, it is highly recommended to register. Doing so provides the firm with legal recognition, which can be crucial for resolving disputes or during any legal proceedings.

What is a Partnership Deed?

A Partnership Deed is a formal written agreement between the partners of a firm. It specifies the key terms of their partnership, including the business’s nature, capital contributions from each partner, the profit-sharing ratio, partners’ rights and duties, and procedures for dissolving the partnership.

How many members can there be in a Partnership Firm?

In India, a Partnership Firm must have a minimum of two members. The maximum number of members allowed in a Partnership Firm is twenty.

What are the types of Partnerships?

There are several different categories of partnerships. These commonly include a General Partnership, a Limited Partnership, and a Limited Liability Partnership (LLP), each with its own distinct characteristics.

What are the advantages of a Partnership Firm?

The benefits of forming a Partnership Firm include its ease of establishment, the advantage of combining resources and expertise from multiple individuals, a shared financial burden among partners, and considerable flexibility in its management structure.

What are the disadvantages of a Partnership Firm?

The drawbacks of a Partnership Firm typically include unlimited liability for partners (except in an LLP), the potential for disagreements among partners, greater difficulty in raising capital compared to corporations, and a degree of instability due to its reliance on the partnership agreement.

How is profit shared in a Partnership Firm?

Profit sharing within a Partnership Firm is generally determined by the Partnership Deed. If the deed does not specify a sharing arrangement, the profits are typically divided equally among all partners.

Can a partner transfer their interest in the Firm?

Yes, a partner is able to transfer their interest in the firm. However, this transfer does not automatically grant the transferee the status of a partner or the right to participate in the firm’s management, unless all other partners provide their consent.