Page Contents

ToggleBRN Registration Online @ Rs. 1100*

If you’re looking to register for a ‘Sanstha Aadhaar’, Tax2Fin is here to make the process simple and stress-free. We offer professional assistance to help you obtain your Sanstha Aadhaar quickly and efficiently, ensuring all requirements are met without delays. Let our expert team handle the details so you can focus on your organization’s goals.

With Tax2Fin’s Sanstha Aadhaar Registration service, you get:

Step-by-step guidance through the entire process

Accurate preparation and submission of documents

Hassle-free, fast-track registration support

Expert advice to ensure full compliance with requirements

Get Free Consultation by Expert

A BRN, commonly known as a Business Registration Number, is a distinct identifier issued to businesses by government bodies or corporate registries. This number serves as official identification and is frequently mandated across various jurisdictions for tax obligations, legal paperwork, and other formal business operations.

The Business Register, now termed “Sanstha Aadhaar,” is a comprehensive database encompassing all active enterprise groups, individual enterprises, and local units contributing to the nation’s economy. This register serves as a foundational element for the System of National Accounts (SNA) and covers all States and Union Territories geographically, aligning with India’s Economic Census scope.

Process for BRN Registration Online

- Determine the Type of Business Entity: Identify your business structure based on the categories provided (e.g., individual, partnership, company).

- Choose a Business Name: Select a suitable and unique name for your business entity.

- Prepare Necessary Documentation: Gather required documents including personal identification, proof of business address, and comprehensive details regarding the business’s structure, ownership, and management.

- Submit Application: Proceed to submit your compiled application to the relevant authority.

- Receive BRN: Once your application undergoes processing and receives approval, your unique Business Registration Number (BRN) will be issued.

- Cancellation: The SAN (Sanstha Aadhaar) can be cancelled conveniently online by choosing the designated ‘CANCEL’ option.

Documents Required for BRN Registration Online

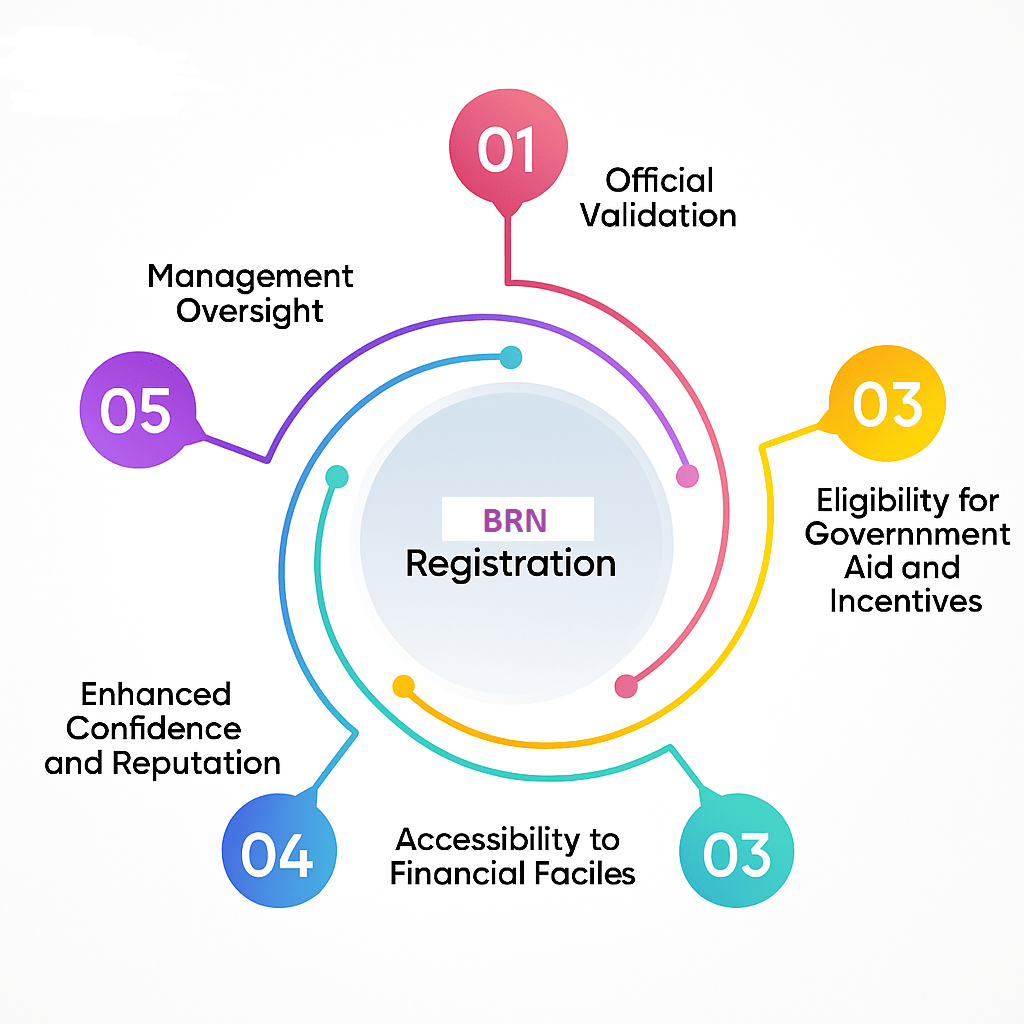

Advantages of Sanstha Aadhar Registration

Legal Recognition

Registration grants legal recognition to an institution, which is vital for its official existence. It formalizes the entity's standing with legal authorities and other stakeholders.

Access to Government Schemes and Subsidies

Registered entities frequently qualify for various government schemes and subsidies specifically tailored for them. This can encompass financial aid, tax exemptions, and other supportive measures.

Ease of Getting Loans and Funds

Financial institutions and investors are more inclined to provide credit or funding to registered entities due to their legally recognized status. This can be crucial for an institution's growth and expansion.

Improved Trust and Credibility

Registration significantly boosts an institution's credibility, which is essential for building trust among key stakeholders, including members, donors, clients, and the general public.

Compliance and Governance

The registration process often mandates that institutions comply with specific governance standards and measures, aiding in the establishment of a more organized and transparent operational system.

- Firm: Applies to all private firms conducting operations within Rajasthan.

- NGOs: Encompasses all Non-Governmental Organizations (NGOs) and Voluntary Organizations (VOs) active in Rajasthan.

- Government: Includes all State Government and Central Government departments that maintain an office in Rajasthan.

- Autonomous/Semi Government: Pertains to all Semi-Government Institutions, such as Banks, LIC, and similar entities, that have an office presence in Rajasthan.

FAQs

Is there a fee for BRN registration online?

Yes, most jurisdictions charge a fee to process BRN registration. The exact amount can vary based on the specific location and the type of business you are registering.

How long does it take to get a BRN?

The processing time for a Business Registration Number (BRN) varies, typically taking a few days to several weeks. This timeline depends on the jurisdiction and the timely submission of all required documents and fees.

Do I need a BRN if I'm a sole proprietor?

Yes, in most legal jurisdictions, even sole proprietors are mandated to obtain a Business Registration Number (BRN). This is essential for conducting legal business operations.

Is BRN the same as a tax identification number?

No, a Business Registration Number (BRN) is distinct from a tax identification number. However, depending on a country’s specific regulatory framework, one number might occasionally serve both purposes.

What if I have multiple business locations?

If you operate multiple business locations, whether you need a separate BRN for each or a single BRN covering all depends on local laws. It’s important to check the specific regulations in your area.

Can my BRN be revoked or cancelled?

Yes, a Business Registration Number (BRN) can indeed be revoked or cancelled. This typically occurs under specific circumstances such as non-compliance with legal requirements, business bankruptcy, or the closure of the business.