Page Contents

TogglePF/ESI Registration

If your business has a growing workforce and you want to secure their future with strong insurance and financial safety measures, Tax2Fin is here to help. We’ll assist you in navigating all PF (Provident Fund) and ESI (Employees’ State Insurance) requirements, ensuring your business stays compliant while delivering essential benefits to your employees. Let us handle the complexities so you can focus on building a strong, motivated team.

With Tax2Fin’s PF & ESI Registration service, you get:

Expert guidance on eligibility and compliance requirements

Complete support in preparing and submitting applications

Hassle-free, timely registration process

Assurance of meeting all statutory obligations

Improved employee trust and retention through social security benefits

Get Free Consultation by Expert

Provident Fund (PF) and Employee State Insurance(ESI)

Provident Fund (PF): The Provident Fund (PF) is a government-mandated retirement savings plan utilized in India, serving as a primary method for employees in the organized sector to build a retirement corpus. Both the employee and the employer contribute a set percentage of the employee’s basic salary and dearness allowance to the PF account monthly. Currently, in India, this rate is generally 12% of the basic salary plus dearness allowance, with contributions made by both parties. In India, the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952, governs Provident Fund PF registration.

Entities (Employer)Required to Register for PF

Organizations with 20 or More Employees

Any establishment, including factories, businesses, and other entities as defined by the Act, that employs 20 or more individuals is mandatorily required to register for the Employees’ Provident Fund.

Voluntary Registration

Establishments with fewer than 20 employees have the option to voluntarily register for PF. Once an establishment chooses PF registration, it remains covered under the Act, even if its employee count subsequently drops below the mandated threshold.

Employee Eligibility

Salaried Employees

Generally, any salaried employee whose monthly income is below ₹15,000 is mandatorily required to be enrolled in the PF scheme by their employer.

Employees Earning More than ₹15,000

Those earning above ₹15,000 per month have the option to either opt-in or opt-out of the scheme. However, if they choose to opt-in at any point, they cannot subsequently opt out.

Benefits for Employees

- Retirement Savings: PF serves as a crucial savings mechanism for retirement, providing employees with financial stability during their post-employment years.

- Compounding Interest: Funds accumulated in PF accounts accrue interest, compounded annually, which helps in building a substantial corpus over an extended period.

- Tax Exemption: PF contributions qualify for tax deductions under Section 80C of the Income Tax Act. Furthermore, the interest earned and the final maturity amount are typically tax-exempt, making it a tax-efficient investment.

- Emergency Fund: PF allows for partial or full withdrawals under specific circumstances, such as marriage, education, medical emergencies, home loan repayment, and unemployment, offering financial assistance during critical times.

- Insurance Cover: Through the Employees’ Deposit Linked Insurance Scheme (EDLIS), PF members receive a life insurance cover, adding an extra layer of financial security.

- Pension Benefit: A portion of the employer’s contribution is directed towards the Employees’ Pension Scheme (EPS), which provides a pension payout after an employee’s retirement.

Benefits for Employers

- Retirement Savings: PF serves as a crucial savings mechanism for retirement, providing employees with financial stability during their post-employment years.

- Compounding Interest: Funds accumulated in PF accounts accrue interest, compounded annually, which helps in building a substantial corpus over an extended period.

- Tax Exemption: PF contributions qualify for tax deductions under Section 80C of the Income Tax Act. Furthermore, the interest earned and the final maturity amount are typically tax-exempt, making it a tax-efficient investment.

- Emergency Fund: PF allows for partial or full withdrawals under specific circumstances, such as marriage, education, medical emergencies, home loan repayment, and unemployment, offering financial assistance during critical times.

- Insurance Cover: Through the Employees’ Deposit Linked Insurance Scheme (EDLIS), PF members receive a life insurance cover, adding an extra layer of financial security.

- Pension Benefit: A portion of the employer’s contribution is directed towards the Employees’ Pension Scheme (EPS), which provides a pension payout after an employee’s retirement.

Tax Implication Based on Duration of Contribution

Withdrawal Before 5 Years of Continuous Service: If you withdraw your PF balance prior to completing five years of continuous service, the entire amount becomes taxable in the year of withdrawal.

- The employer’s PF contribution and its accrued interest are added to your income and taxed according to your applicable tax slab.

- Any amount previously deducted under Section 80C for your PF contributions also becomes taxable.

- Furthermore, interest earned on your own PF contributions is taxed as “Income from other sources.”

Withdrawal After 5 Years of Continuous Service: PF withdrawal after completing five years of continuous service is entirely exempt from tax.

- This exemption applies to your own contributions, the employer’s contributions, and all accumulated interest.

Exceptions to the 5-Year Rule

- Termination of Employment: If a PF withdrawal before five years of service occurs due to the employee’s ill health, the employer’s business discontinuation, or other factors beyond the employee’s control (such as layoffs), the withdrawal amount is not taxable.

- Transfer of PF: When you transfer your PF amount from one employer’s account to another, this action is not classified as a withdrawal, and therefore, it does not incur any tax liability.

Tax Deducted at Source (TDS) on withdrawal

- TDS on Withdrawal: TDS is applied at a rate of 10% if the withdrawal amount exceeds ₹50,000 and the employee has completed less than 5 years of service.

- No TDS: TDS may not be deducted if your PAN is provided and Form 15G (for individuals below 60 years) or Form 15H (for senior citizens 60 years and above) is submitted, indicating a low or nil tax liability on your total income, including the PF withdrawal.

Due Date for PF Deposit

- Monthly Contribution: Both employer and employee PF contributions must be deposited by the 15th day following the end of each month. For instance, the PF contribution for the month of January is required to be deposited by February 15th.

Due Date for PF Return Filing

- Monthly Returns: In addition to depositing the PF contributions, employers are obligated to file monthly returns. The deadline for this is typically the 15th of the subsequent month, aligning with the PF deposit due date. These monthly returns detail employee information, their wages, and the total PF amounts deducted and paid.

- Annual Returns: In specific situations, annual returns may also be mandatory. The typical due date for filing these annual returns is April 30th of the following financial year.

Employee State Insurance (ESI)

Employee State Insurance (ESI) is a self-financing social security and health insurance program for Indian workers. It is administered by the Employee State Insurance Corporation (ESIC), an autonomous body operating under the Ministry of Labour and Employment, Government of India. The scheme aims to shield employees from financial hardship caused by sickness, disability, and death resulting from work-related injuries, while also offering medical care to insured individuals and their families.

Entities Required to Register for ESI

- Factories and Establishments: The ESI scheme applies to all factories and designated establishments (such as shops, hotels, restaurants, cinemas, road-motor transport, newspaper establishments, etc.) that employ a specific number of individuals. This number generally stands at 10 or more employees, though it can vary by state legislation.

- Employee Wage Ceiling: ESI registration is also mandated if an establishment employs individuals whose wages do not exceed the limit set by the ESI Act. As of the latest update, this wage ceiling is ₹21,000 per month (or ₹25,000 for persons with disabilities).

- Coverage Across India: The ESI scheme is rolled out in phases and is now active across most parts of India. Employers must register if their establishment is situated within an area where the ESI Act is applicable.

- Mandatory Registration: Registration under the ESI Act is compulsory for entities that meet the aforementioned criteria. Failure to comply can lead to penalties.

- Voluntary Coverage: In specific instances, establishments with fewer employees than the standard requirement can opt for voluntary coverage under the ESI scheme.

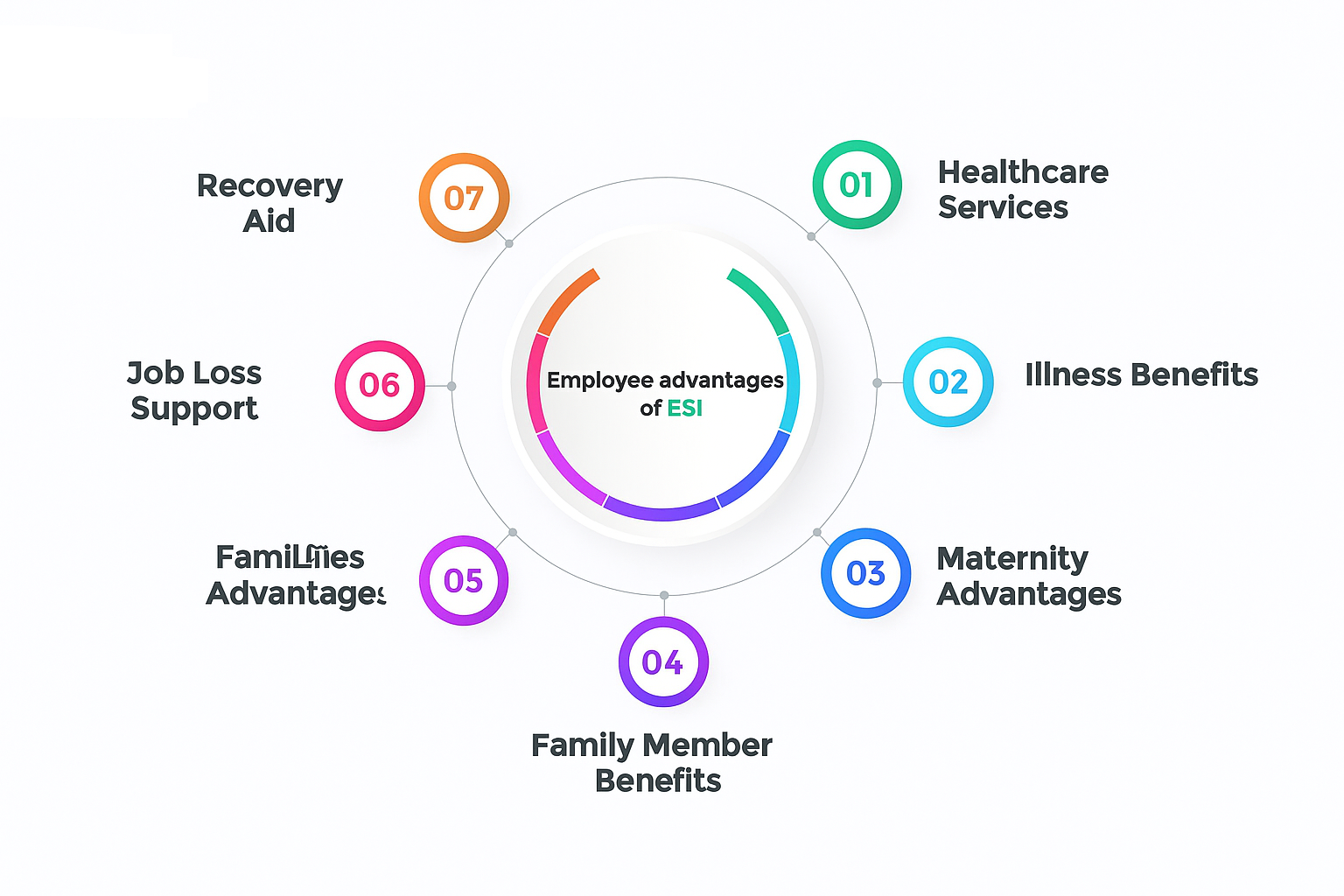

Benefits for Employees

- Medical Care: Comprehensive medical services are extended to employees and their families, including full medical coverage at ESI hospitals and dispensaries.

- Sickness Benefits: Financial aid is provided as sickness benefits when an insured employee is unable to work due to illness.

- Maternity Benefits: Pregnant women are eligible for maternity benefits for a specified duration, ensuring financial support throughout their maternity leave.

- Disability Benefits: In instances of disability resulting from an employment injury or occupational disease, the ESI scheme offers financial assistance to the employee.

- Dependents’ Benefits: Should an employee unfortunately pass away due to an employment injury, their dependents receive financial assistance.

- Unemployment Allowance: The Rajiv Gandhi Shramik Kalyan Yojana, part of the ESI scheme, grants an unemployment allowance to workers who have lost their jobs due to retrenchment or factory closure.

- Rehabilitation Allowance: Employees who become disabled due to an employment injury are entitled to a rehabilitation allowance.

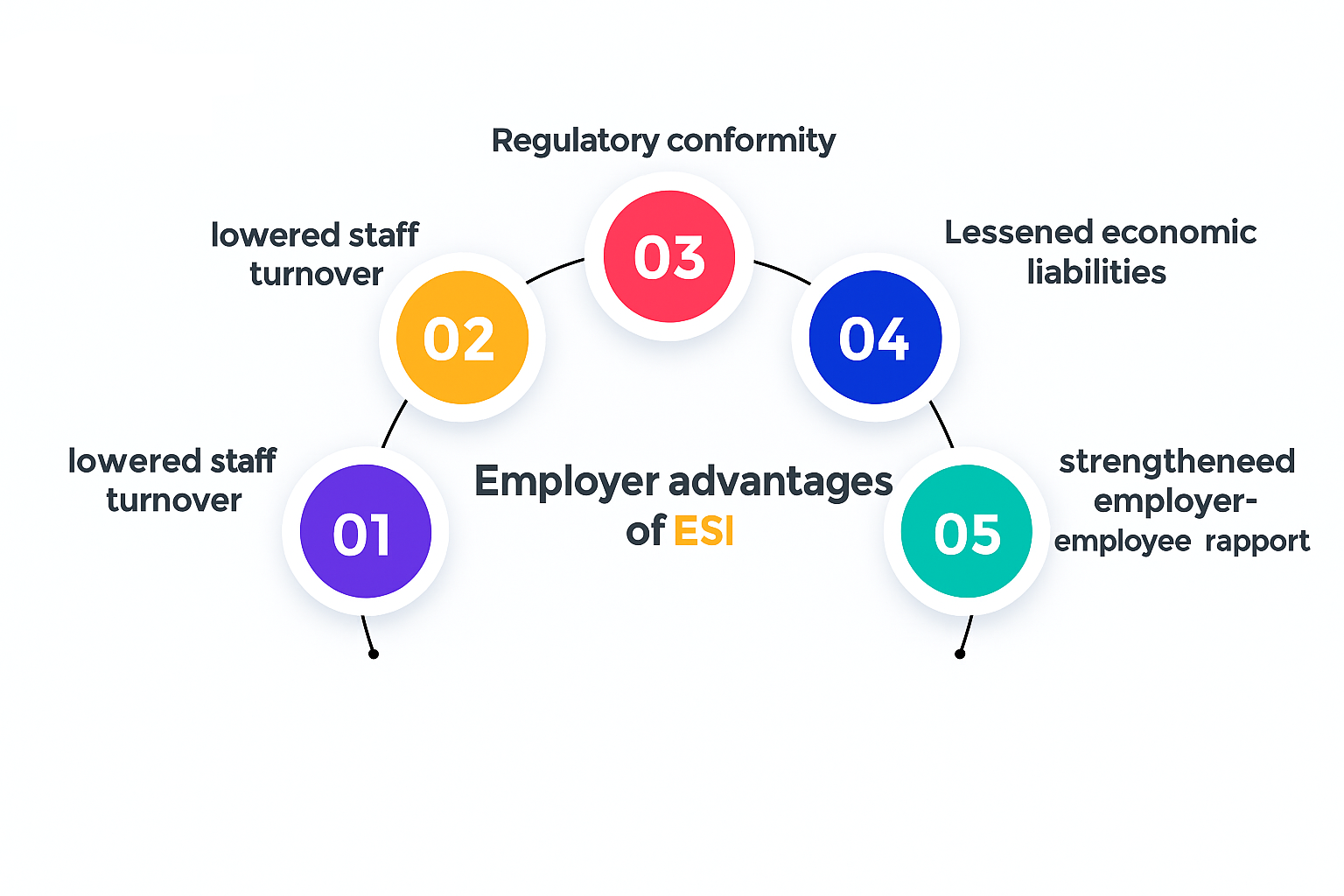

Benefits for Employers

- Reduced Employee Turnover: Offering comprehensive social security benefits through ESI boosts job satisfaction, which can lead to a decrease in employee turnover rates.

- Enhanced Employee Morale: Employees’ morale can be significantly improved by the assurance that they and their families are covered for medical and other unforeseen contingencies.

- Legal Compliance: Registering and contributing to the ESI scheme ensures compliance with the Employees’ State Insurance Act, helping employers prevent legal issues and avoid penalties.

- Reduced Financial Liability: The ESI scheme limits the financial responsibility of employers in situations of employee sickness, maternity, disability, or death resulting from employment injury.

- Improved Employer-Employee Relationship: Contributing to employee welfare through ESI enhances the employer’s public image and fosters better relations between employers and employees.

Due Date for ESI Deposit

- Monthly Contribution: Employers are mandated to deposit both their own and the employee’s share of ESI contributions by the 15th day of the month immediately following the contribution month. For instance, the ESI contribution for March must be deposited by April 15th.

Due Date for ESI Return Filing

Half-Yearly Returns: ESI returns are required to be filed biannually. These returns detail employee information and the contributions made over the respective period.

Return Periods and Due Dates:

- For the period spanning April to September, the return filing deadline is November 11th.

- For the period covering October to March, the return filing deadline is May 11th. Here’s the paraphrased information on ESI half-yearly returns, maintaining a similar length for each point:

FAQs

Can I withdraw my PF balance?

Yes, employees can partially or fully withdraw their PF balance under specific circumstances. These include retirement, unemployment, or to cover expenses for home loans or medical emergencies.

What is UAN?

UAN, or Universal Account Number, is a unique identification number assigned to each PF member. It simplifies the management of PF accounts and ensures seamless portability when changing jobs.

Is PF contribution mandatory?

Yes, contributing to the Provident Fund (PF) is mandatory for both eligible employees and their employers. This is stipulated under the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952.

How to check PF balance?

You can check your PF balance online via the EPFO portal or the UMANG app. Alternatively, if your UAN is registered, you can check it by sending an SMS or making a missed call.

Can I opt out of PF?

Employees earning over Rs. 15,000 monthly at the time of joining may be eligible to opt out of PF. However, this decision must be made at the very beginning of their employment.

What is ESI?

ESI is a self-financing social security and health insurance scheme designed for Indian workers. It offers a range of medical, monetary, and other benefits to its members.

Who is covered under ESI?

Employees earning up to Rs. 21,000 per month are covered under ESI. This applies to those working in non-seasonal factories that have 10 or more employees.

What are the benefits of ESI?

ESI benefits include comprehensive medical treatment for both the employee and their family. It also provides cash benefits during periods of illness, maternity, and compensation for employment-related injuries.