Page Contents

ToggleImport Export Code (IEC) Registration

Looking to export goods and need an Import Export Code (IEC)? Tax2Fin is here to make the entire process easy and hassle-free. Our expert team will guide you through every step of obtaining this mandatory identification number, ensuring smooth compliance with government regulations so you can focus on growing your business internationally.

With Tax2Fin’s IEC Registration service, you get:

Complete guidance on eligibility and documentation requirements

Accurate preparation and submission of your IEC application

Fast, seamless processing with minimal delays

Get Free Consultation by Expert

Import Export Code Registration

An IEC Code, or Import Export Code, is a crucial 10-digit business identification number essential for all import and export activities in India. Issued by the Directorate General of Foreign Trade (DGFT) under the Ministry of Commerce and Industries, Government of India, this code is PAN-based, meaning it’s unique to a single PAN. No entity is permitted to hold more than one IEC Code. It’s mandatory to cite the IEC Code in various documents critical to the import/export process, including customs clearance papers, shipping documents, and bank remittance forms.

Process for IEC Registration

Prepare Required Documents

Before starting the application, collect all necessary documents. This typically involves:

- PAN Card of the individual or business.

- A valid Email and Mobile Number.

- Proof of business address (e.g., electricity bill, rent agreement, or ownership deed).

- Bank Certificate or a Cancelled Cheque showing account details and the entity's name.

- A passport-size photograph.

Visit the DGFT Website

Navigate to the official Directorate General of Foreign Trade (DGFT) website to commence the IEC registration process.

Create an Account

New users must create an account on the DGFT portal, requiring basic information such as email ID, mobile number, and PAN.

Fill the Application Form (ANF 2A)

Once logged in, choose to 'Apply for IEC' or 'IEC Modification' (if updating an existing IEC). Accurately complete the ANF 2A application form.

Upload Documents

Upload scanned copies of all required documents. Ensure clarity and compliance with DGFT website specifications.

Pay the Application Fee

A small fee is charged for IEC registration. Payment can be made online via electronic fund transfer from specified banks.

Submit the Application

After filling the form and uploading documents, review for any errors and then submit your application.

Verification and Approval

The DGFT office will process your application, conducting verification if necessary. Once satisfied, the IEC will be granted.

Receive IEC Code

Upon approval, your IEC Code will be generated and sent via email, also being available for download from the DGFT portal.

Keep IEC Updated

Ensure your IEC remains current by applying for modifications through the DGFT portal if any details, such as address or bank information, change.

Documents Required for IEC Registration

Business address proof.

(Incorporation Documents MOA, AOA, Partnership Deed, GST Number, Electricity Bill etc.)

Bank account details of the business.

(with Cancelled Cheque copy)

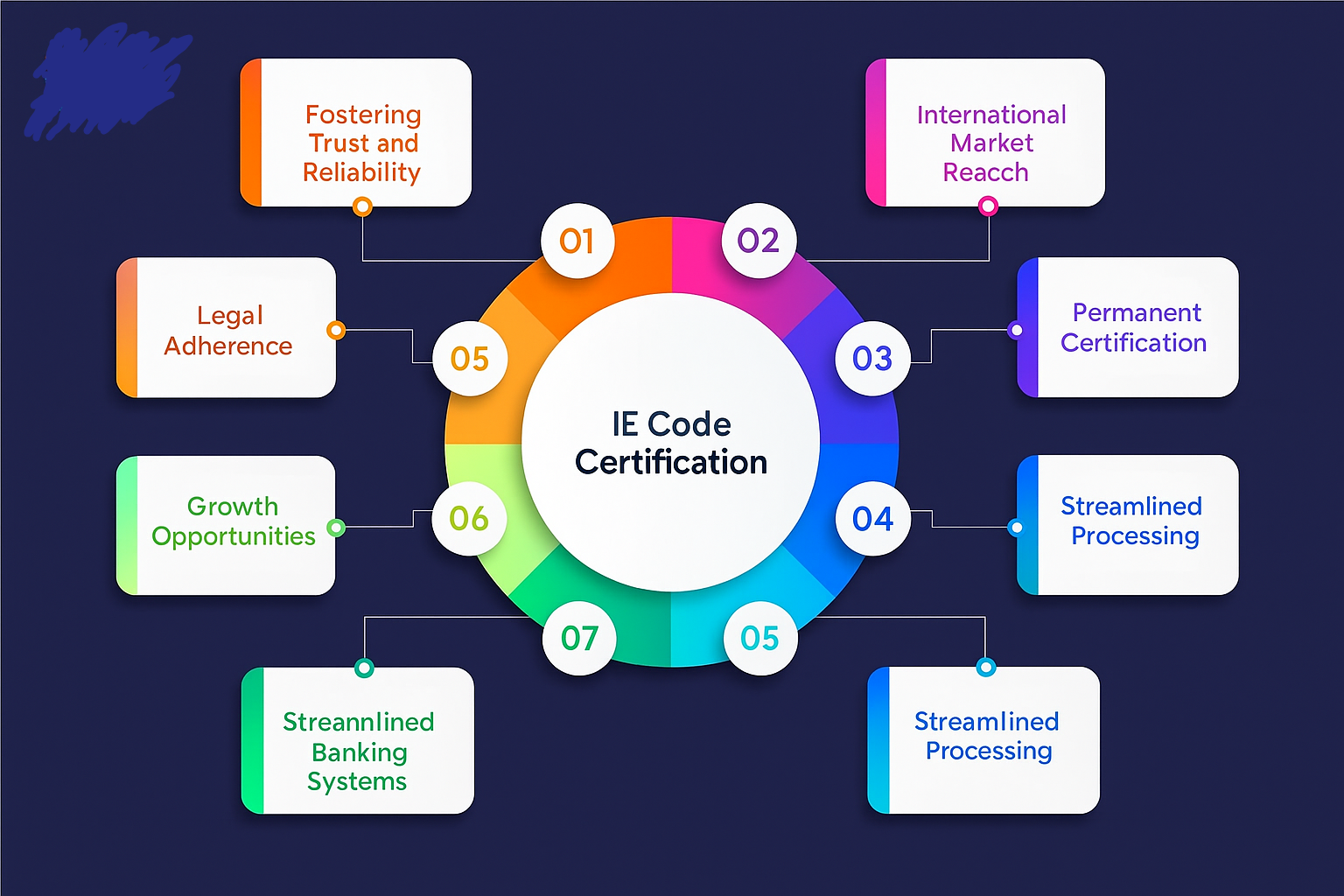

Advantages of IEC Registration

Access to Global Market

IEC registration is essential for businesses aiming to expand internationally, providing the legal authorization to import and export goods.

No Need for Renewal

A significant advantage of the IEC is its lifetime validity, eliminating the need for periodic renewals, which makes it hassle-free once acquired.

Eligibility for Government Schemes

Companies holding an IEC registration can access benefits from bodies like the Export Promotion Council, Customs, and Export Credit Guarantee Corporation (ECGC), qualifying for various government export schemes and incentives.

Ease in Clearance

Businesses with an Import Export Code experience simpler customs clearance for both imports and exports, facilitating a more streamlined process for clearing agents.

Simplified Banking Procedures

For international trade transactions, having an Import Export Code simplifies various banking processes. Banks typically require the IEC for handling foreign exchange-related transactions.

Opportunities for Expansion

With an Import Export Code, businesses can explore and extend their reach into diverse global markets, potentially leading to enhanced brand recognition and overall business growth.

Legal Compliance

Obtaining an Import Export Code ensures adherence to all laws and regulations governing the import and export of goods and services within India, thereby preventing potential legal complications and penalties.

Building Trust and Credibility

Possessing an Import Export Code enhances a business's credibility, signifying its registration with the DGFT, which can foster greater trust among international partners and customers.

When IEC Registration is mandatory?

Clearance of Shipments:

- Imports: Importers are required to provide their IEC code to customs authorities for the clearance of incoming goods.

- Exports: Exporters must furnish their IEC code to customs authorities for the clearance of outgoing goods.

Banking Transactions:

- Outward remittances: Importers need to disclose their IEC code to banks when transferring funds internationally for import-related purposes.

- Foreign currency receipts: Exporters must inform their banks when receiving payments in foreign currency for export transactions.

Customs Ports:

- Exports: Exporters are required to present their IEC code at customs ports during the export process to facilitate shipment clearance.

Licenses and Certifications:

- Food license: Obtaining a food license in India mandates the possession of an IEC code.

- APEDA license: Similarly, businesses aiming for an Agriculture and Processed Food Products Export Development Authority (APEDA) license must have an IEC code.

Export Subsidies:

- Availing benefits: Exporters wishing to claim export subsidies are required to provide their IEC code to the relevant export promotion council.

Key Reminders: The IEC code functions as a unique identification number for all import and export entities within India. Accurately providing your IEC code in these situations is essential for regulatory compliance and to ensure seamless transactions.

Who are exempt from taking IEC Registration?

- Traders registered under GST can utilize their PAN as their Import Export Code.

- Import/export for personal, non-commercial purposes does not necessitate IEC Registration.

- Government entities and recognized charitable institutions are exempt from the requirement of IEC Registration.

- Import/export activities to/from Nepal and Myanmar, when conducted through designated Indo-Myanmar border areas, do not require IEC Registration.

FAQs

How long does it take to get an IEC?

Typically, obtaining an Importer-Exporter Code (IEC) takes about 15-20 days. This timeframe applies after a complete and accurate application has been submitted to the relevant authorities.

What is the validity of an IEC?

An IEC has lifetime validity, meaning it does not expire. However, it is crucial to update your IEC details if any business information changes to ensure continued compliance.

Can I check the status of my IEC application?

Yes, you can easily track the status of your IEC application online. The Directorate General of Foreign Trade (DGFT) website provides a portal for checking your application’s progress.

What are the benefits of having an IEC?

Possessing an IEC is essential for engaging in import and export activities. It also provides access to various government schemes and benefits, significantly enhancing your business’s credibility in international trade.

Can I change my IEC details?

Yes, you are able to amend your IEC details if there are any changes to your business information. You can apply for these amendments online through the DGFT website.

What are the penalties for non-compliance with IEC regulations?

Non-compliance with IEC regulations can lead to severe penalties. These may include financial fines, various penalties, and in more severe cases, even imprisonment.