Page Contents

ToggleMSME Registration @ Rs. 1100*

If you’re a small enterprise, make the most of government benefits by getting MSME Registration quickly and effortlessly. With Tax2Fin’s expert assistance, you can complete your registration within a day, ensuring you gain access to incentives, loans, and subsidies designed to help your business grow. Let us handle the paperwork while you focus on success.

With Tax2Fin’s MSME Registration service, you get:

Step-by-step guidance from experienced professionals

Quick, hassle-free registration within 24 hours

Accurate document preparation and submission

Get Free Consultation by Expert

MSME- Micro, Small, and Medium Enterprises in India

MSME, or Micro, Small, and Medium Enterprises, are vital for the economic and social progress of nations like India. These businesses are generally defined by their investment in plant, machinery, or equipment. For companies aiming to operate in this sector, securing MSME Registration offers significant advantages and assistance with regulatory procedures.

Tax2Fin ensures high satisfaction and quick delivery of your MSME Registration Certificate, managing all government requisites with our expert team. Contact us for efficient MSME registration and complete MSME compliance services.

Classification of MSMEs (Manufacturing/Services Both)

| Category | Investment in Plant & Machinery | Turnover |

|---|---|---|

| Micro Enterprises | ≤ 1 Crore | ≤ 5 Crore |

| Small Enterprises | ≤ 10 Crore | ≤ 50 Crore |

| Medium Enterprises | ≤ 50 Crore | ≤ 250 Crore |

Process for MSME Registration

Visit the Udyam Registration Portal

Navigate to the official online portal designated for Udyam Registration.

Fill in the Details

Input your Aadhaar number along with all other necessary personal and business information.

Validate and Generate OTP

Your entered details will be verified via a One-Time Password (OTP) sent to the mobile number registered with your Aadhaar.

Fill in Investment and Turnover Details

Provide comprehensive information concerning the investment made in your plant and machinery or equipment, as well as the enterprise's annual turnover.

Final Submission and Confirmation

Upon final submission, a unique registration number will be generated, and your Udyam Registration Certificate will be issued.

Documents Required for MSME Registration

Business address proof

Certificate of Incorporation, MOA, AOA, Partnership Deed, Electricity Bill etc.

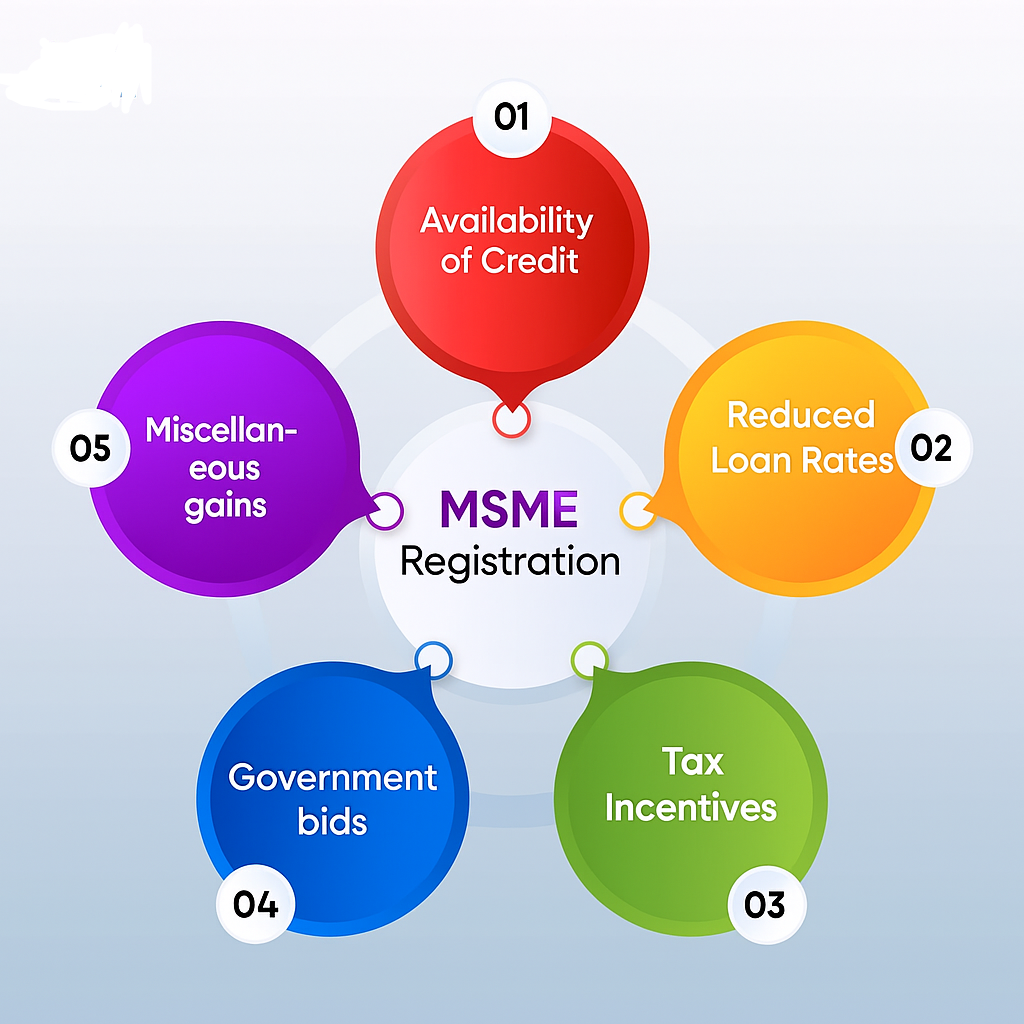

Advantages of LLP Registration

Access to Credit

Facilitated access to credit and eligibility for diverse loan programs, including collateral-free loans via the Credit Guarantee Trust Fund for Micro and Small Enterprises (CGTMSE).

Lower Interest Rates

Potential eligibility for reduced interest rates on loans compared to standard borrowing rates.

Tax Benefits

Eligibility for various tax rebates and specific exemptions as outlined under the Income Tax Act.

Government Tenders

Preferential treatment in securing government tenders and exemption from certain direct tax laws.

Other Benefits

Access to a range of government schemes and incentives, such as general subsidies, capital investment subsidies, and power tariff subsidies.

What is the difference between MSME Registration and Udyam Registration Certificate?

MSME Registration refers to the act of formally registering your business. The Udyam Registration Certificate serves as the official proof of this registration. Essentially, Udyam has replaced older registration platforms and simplified the process, though the fundamental idea of MSME registration and its associated benefits remain unchanged.

| Feature | MSME Registration | Udyam Registration Certificate |

|---|---|---|

| Definition | Process of registering as an MSME | Proof of MSME registration |

| Purpose | Access government benefits | Unlock benefits for registered business |

| Process | Done through Udyam portal | Issued after successful Udyam registration |

| Validity | Lifespan of the business | No renewal required |

| Content | N/A | Business details and registration number |

Contribution by MSMEs

Economic Growth

Employment Generation

Equitable Development

Innovation & Entrepreneurship

FAQs

Is MSME registration mandatory in India?

While MSME (Udyam) registration is not compulsory, it is highly recommended. It offers numerous benefits like access to credit at lower interest rates and eligibility for various government schemes, providing significant advantages for businesses.

What are the benefits of MSME registration?

MSME registration offers several benefits, including priority lending from banks, various tax exemptions, subsidies on power tariffs, and support for capital investment. It also provides assistance with technology upgrades, marketing, and infrastructure development.

Can a trader register under MSME?

No, according to recent notifications, traders are not eligible for MSME registration. This registration is specifically designed for manufacturing and service-providing enterprises.

What is the MSME Samadhaan portal?

The MSME Samadhaan portal is an online platform established to help MSMEs. Businesses can use it to file complaints about delayed payments from their buyers and seek efficient redressal of these issues.

How does the MSME sector contribute to the Indian economy?

The MSME sector is a vital contributor to India’s economy, significantly impacting GDP, exports, and employment generation. It plays a crucial role in fostering the country’s overall economic and social development.

Are there any special schemes for women entrepreneurs in the MSME sector?

Yes, several special schemes are available for women entrepreneurs in the MSME sector, such as the Mahila Udyam Nidhi Scheme, Annapurna Scheme, and Stree Shakti Package. These offer financial aid and reduced interest rates.

What is the collateral-free loan under MSME?

Under the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), MSMEs can access collateral-free loans from banks. The trust acts as a guarantor to the lending institution, reducing the risk for banks.