Page Contents

ToggleLimited Liability Partnership Registration @ Rs. 5,100*

- LLP Registration fees in india Starting at just ₹5,100 + Govt Fees (as per State) + DSC Fees

- Name Approval on MCA, including 2 Digital Signatures (DSC) and 2 DPINs for Designated Partners

- Comprehensive support covering LLP PAN, TAN, and GST Registration with 3 Months of GST Return Filing FREE

Get Free Consultation by Expert

Limited Liability Partnership Registration in India

In today’s business world, the Limited Liability Partnership (LLP) has become a popular and effective way to structure a business. It combines the best features of both traditional partnerships and corporations. Because of its unique design, offering both flexibility and limited liability, it’s an appealing choice for many entrepreneurs and professionals. As more businesses look to optimize their organization, the LLP registration process in India has become a vital initial step. This discussion explores what an LLP is, its features, benefits, drawbacks, and its overall influence on the business environment.

The idea of an LLP is fairly new in many legal systems, including India, where it was established by the Limited Liability Partnership Act of 2008. An LLP is a hybrid business structure that shares characteristics of both a partnership and a company. A crucial aspect of an LLP is that all partners have limited liability. This means their personal assets are protected from the business’s debts and obligations.

LLPs don’t require a minimum capital contribution, which makes them readily available to startups and small businesses. The most important feature of an LLP is the limited liability provided to its partners. This protection means partners aren’t personally responsible for the business’s debts, unlike in a traditional partnership. Additionally, unlike corporations, LLPs offer significant flexibility in management. Partners can directly manage the business, and the internal structure can be customized through the partnership agreement. If you’re looking to set up an LLP, Limited Liability Partnership registration in India provides a simplified way to begin.

Tax2Fin ensures high satisfaction and quick delivery of your Limited Liability Partnership Registration Certificate. Their expert team handles all government requirements. For efficient Limited Liability Partnership registration online and comprehensive compliance services, you can reach out to us.

LLP Registration Process

Obtain Digital Signature Certificates (DSCs)

The initial step requires acquiring Digital Signature Certificates for all designated partners. These DSCs are necessary for electronically signing various documents and forms submitted to the Ministry of Corporate Affairs (MCA).

Apply for Director Identification Number (DIN) or Designated Partner Identification Number (DPIN)

Each designated partner must possess a DIN or DPIN. If a designated partner already holds a DIN from involvement in other companies, that same number can be used.

Reserve the LLP Name

The next step involves submitting an application to reserve the LLP name through the "RUN-LLP" service on the MCA portal. The chosen name must be unique and distinct from any existing company or LLP.

Incorporation of LLP

Once the name receives approval, the incorporation document, specifically Form FiLLiP (Form for incorporation of Limited Liability Partnership), must be filed with the Registrar of Companies (ROC). This form requires details such as the LLP's name, registered office address, information about all designated partners and partners, and their official consent.

File the LLP Agreement:

Following the incorporation, the LLP Agreement must be filed within 30 days. This agreement outlines the mutual rights and responsibilities among the partners and between the LLP and its partners. It is submitted via Form 3 on the MCA portal.

Documents Required

To register a Limited Liability Partnership (LLP) in India, you'll generally need several key documents. These include proof of the registered office's address and a no-objection certificate from the property owner. You'll also need a subscriber's sheet showing the partners' consent. Detailed information for all partners and designated partners is crucial, such as their DPIN/DIN, address proof, and identity proof. Lastly, Digital Signature Certificates (DSCs) for the designated partners are a mandatory requirement.

Payment of Fees( LLP Registration Fees in india )

The incorporation process involves paying the necessary government fees and stamp duty, which will vary depending on the specific state where the LLP is being incorporated.

Approval and Certificate of Incorporation

After reviewing all documents and details, the ROC will issue a Certificate of Incorporation. At this point, the LLP is legally recognized and can begin its business operations.

Apply for PAN and TAN

Subsequent to incorporation, applications must be made for the Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the LLP.

Open a Bank Account

Finally, a bank account must be opened in the name of the LLP to manage its financial transactions.

Additional Registrations

Depending on the nature of the business, the LLP might need to complete further registrations for Goods and Services Tax (GST), Professional Tax, Employees’ State Insurance (ESI), Provident Fund (PF), and any other relevant statutory requirements. It is important to understand the mandatory annual compliance requirements for LLPs to avoid penalties and ensure smooth operations.

Documents Required for LLP Registration Online

Director and Shareholder PAN Cards

For all proposed Directors, you'll need their PAN Card. For all Indian Shareholders and Directors, both their PAN and Aadhaar Cards are required.

Business Address Verification

If the business property is owned, provide a copy of the Registry and the latest government electricity bill. If the property is rented, you'll need the Rent Agreement, the latest government electricity bill, and a No-Objection Certificate (NOC) from the landlord.

Additional Director Documents

Each proposed Director must submit a utility bill, telephone bill, mobile bill, or bank statement that is no older than two months as proof of address. You'll also need their mail ID and mobile number, along with the Draft Articles of Association and Draft Memorandum of Association.

Photographs and ID

Finally, you'll need latest passport-sized photographs of all proposed Directors, along with their Aadhaar Card or Passport for identification.

Checklist for LLP Registration

- Digital Signature Certificates (DSCs) are needed for all designated partners.

- Each designated partner must have a Director Identification Number (DIN or DPIN).

- The LLP Name Approval must be secured through the RUN-LLP service.

- The Incorporation Documents need to be filed with the Registrar of Companies (ROC).

- The LLP Agreement must be officially submitted.

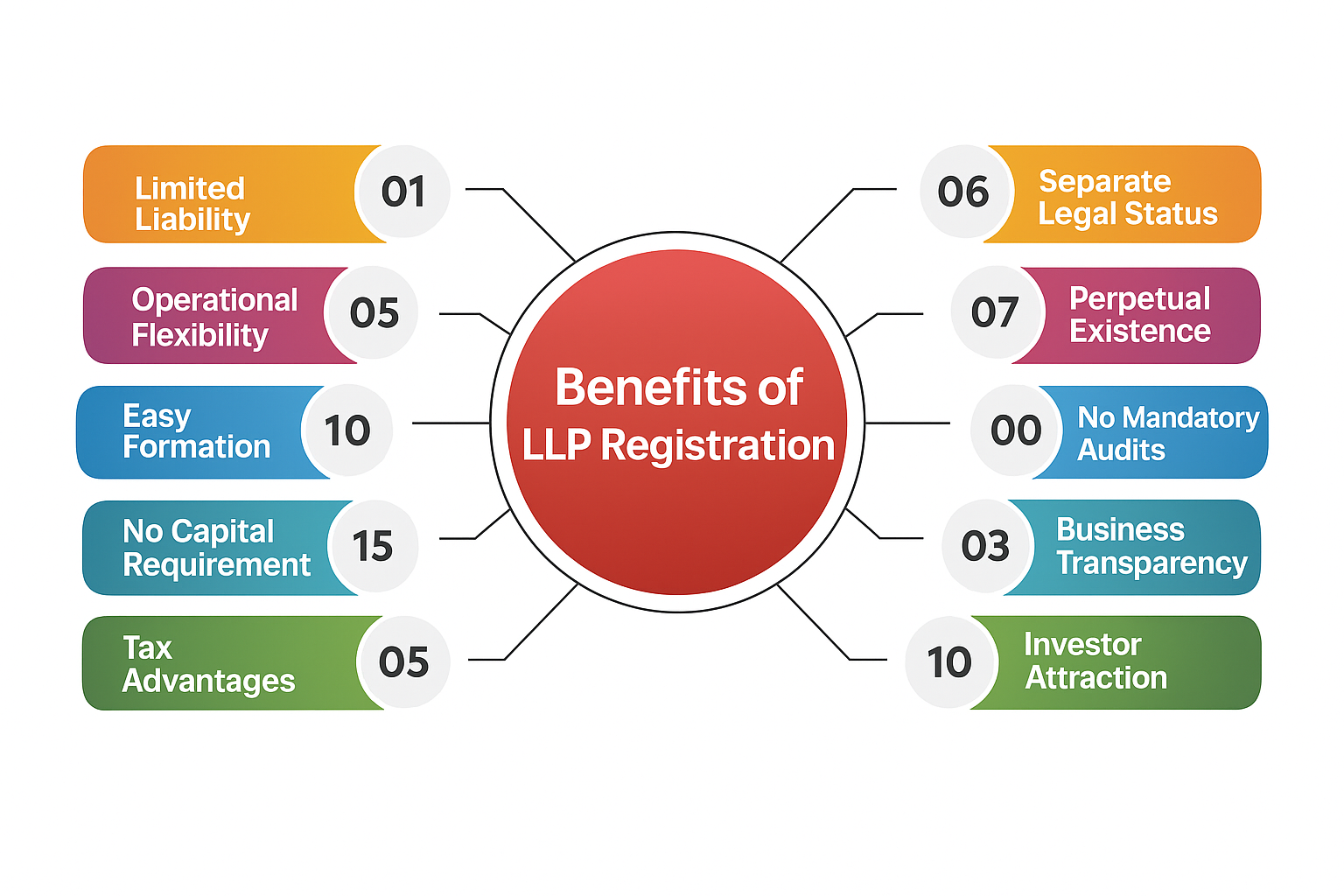

Advantages of LLP Registration

Limited Liability Protection

A major benefit of an LLP is that it protects partners' personal assets from the business's debts. Partners are only responsible for the amount they've invested in the LLP, safeguarding their personal wealth.

Flexibility in Management and Operation

LLPs offer considerable freedom in how they're managed and operated. Unlike rigid corporate structures, partners can organize and run the business according to their own agreement.

Ease of Formation and Compliance

Establishing an LLP is generally simpler than forming a corporation, with a straightforward registration process and fewer ongoing compliance obligations.

No Minimum Capital Requirement

There's no mandatory minimum capital needed to start an LLP. This makes it an accessible option for small to medium-sized businesses or professionals who want to launch ventures without significant upfront investment.

Tax Benefits

LLPs can offer specific tax advantages depending on the jurisdiction. For example, some countries don't subject LLPs to corporate tax, taxing profits only at the individual partner level, thereby avoiding double taxation.

Separate Legal Entity

An LLP functions as a distinct legal entity apart from its partners. This means it can independently own assets, enter into contracts, and engage in legal actions in its own name.

Perpetual Succession

An LLP has continuous existence, unaffected by changes in partners or even a partner's death, ensuring the business can carry on without interruption.

No Requirement for Mandatory Audit

In certain places, LLPs aren't required to have their accounts audited if their turnover and capital contribution remain below specific thresholds, simplifying their financial reporting.

Transparency in Business

LLPs are mandated to keep and file records with authorities, which promotes transparency in operations and enhances credibility with stakeholders.

Attracting Investors

The LLP structure can be appealing to investors, especially for startups and growing businesses, due to its blend of limited liability and operational adaptability.

For expert LLP company registration in India, contact Tax2Fin to get assistance throughout the LLP registration process.

How Tax2Fin helps you in the LLP Firm Registration Process?

We are committed to providing our clients with full support. For your Limited Liability Partnership Registration in India, a dedicated personal manager will be assigned to guide you efficiently through every step of the process.

We will provide assistance in the following areas:

- LLP Name Search: Helping you find and select a suitable name for your LLP.

- LLP Name Approval: Managing the process to get your chosen LLP name officially approved.

- Obtaining DPIN (Up to 2 Directors): Assisting in the acquisition of Designated Partner Identification Numbers for up to two directors.

- Assist in drafting of MOA & AOA: Providing support in preparing your Memorandum of Association and Articles of Association.

- Filing of SPICe+ Form on the MCA portal: Handling the submission of your SPICe+ Form through the Ministry of Corporate Affairs portal.

- Getting you your LLP’s Certificate of Incorporation, PAN & TAN: Ensuring you receive your LLP’s Certificate of Incorporation, Permanent Account Number (PAN), and Tax Deduction and Collection Account Number (TAN).

Steps to be taken care of Post Registration of the LLP

Income Tax Return Filing

This is an annual task where companies must file their Income Tax Return, specifically ITR-6. If applicable, a Tax Audit report also needs to be submitted, both requiring a digital signature.

ROC Annual Filing

Performed once per year, this activity involves uploading the Annual Return to the Ministry of Corporate Affairs (MCA) portal after the financial year ends, the income tax return is filed, and the ROC Audit report is ready. The return must be digitally signed by both the Directors and the Chartered Accountant who conducted the audit.

Opening a Bank Account

A bank account must be opened in the LLP's name. For this, you will need documents such as the Certificate of Incorporation, the LLP Agreement, the LLP's PAN card, and other relevant papers.

Apply for PAN and TAN

If not already obtained during the incorporation phase, it is necessary to apply for the Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the LLP.

Goods and Services Tax (GST) Registration

An LLP is required to register for Goods and Services Tax (GST) if its projected turnover surpasses the set threshold, or if it engages in supplying goods or services between different states.

FAQs

What is an LLP?

A Limited Liability Partnership (LLP) is a type of business structure that combines elements of both traditional partnerships and corporations. It offers partners the benefit of limited liability, meaning their personal assets are protected from business debts and obligations. This structure allows for direct management of the business while providing a legal framework that formalizes its operation.

How does an LLP differ from a traditional partnership?

The main distinction between an LLP and a traditional partnership lies in the liability of the partners. In an LLP, partners are only liable up to the amount of their investment, and they are shielded from the negligence or misconduct of other partners. In contrast, traditional partnerships typically hold partners jointly and severally liable for all business debts, exposing their personal assets.

Who should consider forming an LLP?

LLPs are particularly well-suited for professionals like lawyers, accountants, consultants, and other service providers. They are also a good option for small and medium-sized businesses that desire a flexible management structure while benefiting from limited liability protection. The LLP model balances operational ease with legal safeguards for its members.

What are the primary advantages of an LLP?

The key benefits of an LLP include strong limited liability protection for partners, safeguarding their personal assets. LLPs offer significant operational flexibility, allowing partners to structure their internal governance as they see fit. There is no mandatory minimum capital requirement to form an LLP, and the setup and ongoing management are generally simpler compared to a full corporation, making it an attractive option for many businesses.

How is an LLP taxed?

Generally, LLPs are treated as partnerships for tax purposes. This means that the profits of the LLP are passed through to the individual partners and are taxed at their personal income tax rates. This structure typically helps to avoid the issue of double taxation, which can occur in corporate structures where profits are taxed at both the company level and when distributed as dividends to shareholders.

What is the extent of a partner's liability in an LLP?

In an LLP, each partner’s financial liability is limited to the amount they have invested or committed to the partnership. This means that, in most cases, their personal assets, such as homes or savings, are protected from any business debts, losses, or legal claims against the LLP. This limited exposure is a significant advantage, providing security for individual partners.

Does an LLP have a perpetual existence?

Yes, an LLP is recognized as a separate legal entity, meaning it has perpetual existence. This implies that the LLP continues to operate and exist independently of any changes in its partners. The retirement, death, or departure of a partner does not lead to the dissolution of the LLP, ensuring business continuity and stability.

How is an LLP managed?

The management of an LLP is primarily governed by the terms outlined in its LLP agreement. This agreement specifies the roles, responsibilities, and decision-making processes among the partners. Partners have the flexibility to define their respective contributions to the business operations, allowing for a customized and adaptable management structure that suits the specific needs and goals of the partnership. budget for the incorporation process. Proper planning and financial considerations are essential for a smooth registration process and compliance with legal requirements.