Page Contents

TogglePartnership Deed Agreement

Ensure your Partnership Deed is flawless and protected against future tax liabilities with Tax2Fin’s expert assistance. Our team meticulously reviews and corrects any deficiencies to safeguard your partnership from potential tax challenges, especially those related to partnership registration. Let us help you achieve compliance and peace of mind for your business.

With Tax2Fin’s Partnership Deed Review and Assistance, you get:

Detailed review of your existing Partnership Deed

Identification and correction of legal and tax-related gaps

Guidance on compliance with partnership laws and registration requirements

Protection against future tax disputes and liabilities

Get Free Consultation by Expert

Partnership Deed Registration

A partnership deed is a written contract between two or more individuals forming and operating a business together. Its primary purpose is to define the rights, responsibilities, and obligations of each partner within the business. In India, it acts as a comprehensive rulebook for the partnership, covering aspects from partner involvement and profit-sharing methods to procedures for partnership dissolution. This document is vital for preventing misunderstandings and disputes among partners, offering a clear guide for business management and operations.

Key Elements in Partnership Deed

- Name and Nature of the Business: Clearly specify the official name under which the partnership will operate and precisely define the type or scope of business activities it will engage in.

- Duration of Partnership: Indicate whether the partnership is established for a fixed duration, a particular project, or if it is intended to continue indefinitely.

- Capital Contribution: Detail the exact amount of capital each partner will contribute to the partnership, specifying whether it’s in the form of cash, property, or services.

- Profit and Loss Sharing: Outline the method for distributing profits and losses among the partners. While often proportional to capital contributions, the deed must clearly state the precise terms.

- Management and Decision Making: Define each partner’s specific roles and responsibilities, especially regarding daily operations. Also, stipulate how decisions will be reached, whether by majority, consensus, or a designated managing partner.

- Salaries and Drawings: Specify if any partner will receive a salary for their involvement and establish the conditions under which partners can withdraw funds from the business.

- Admission and Withdrawal of Partners: Provide clear guidelines for integrating new partners or the departure of existing ones, including the method for settling their capital accounts.

- Dispute Resolution: Include established procedures for resolving disagreements among partners, which could range from mediation to formal arbitration.

- Dissolution Terms: Outline the circumstances under which the partnership might be dissolved and detail the process for winding up the business, including the distribution of assets.

- Amendments: Clearly state the method by which the partnership deed can be modified, ensuring adaptability for future changes within the partnership.

- Banking and Financial Arrangements: Detail the specifics of banking operations, including who has authorization to sign checks and access the partnership’s financial accounts.

- Books, Records, and Auditing: Specify how the business’s financial records will be maintained and establish the frequency of audits.

- Death or Incapacity of a Partner: Provide a plan for scenarios involving a partner’s death or incapacitation, outlining the implications for partnership shares and ongoing operations.

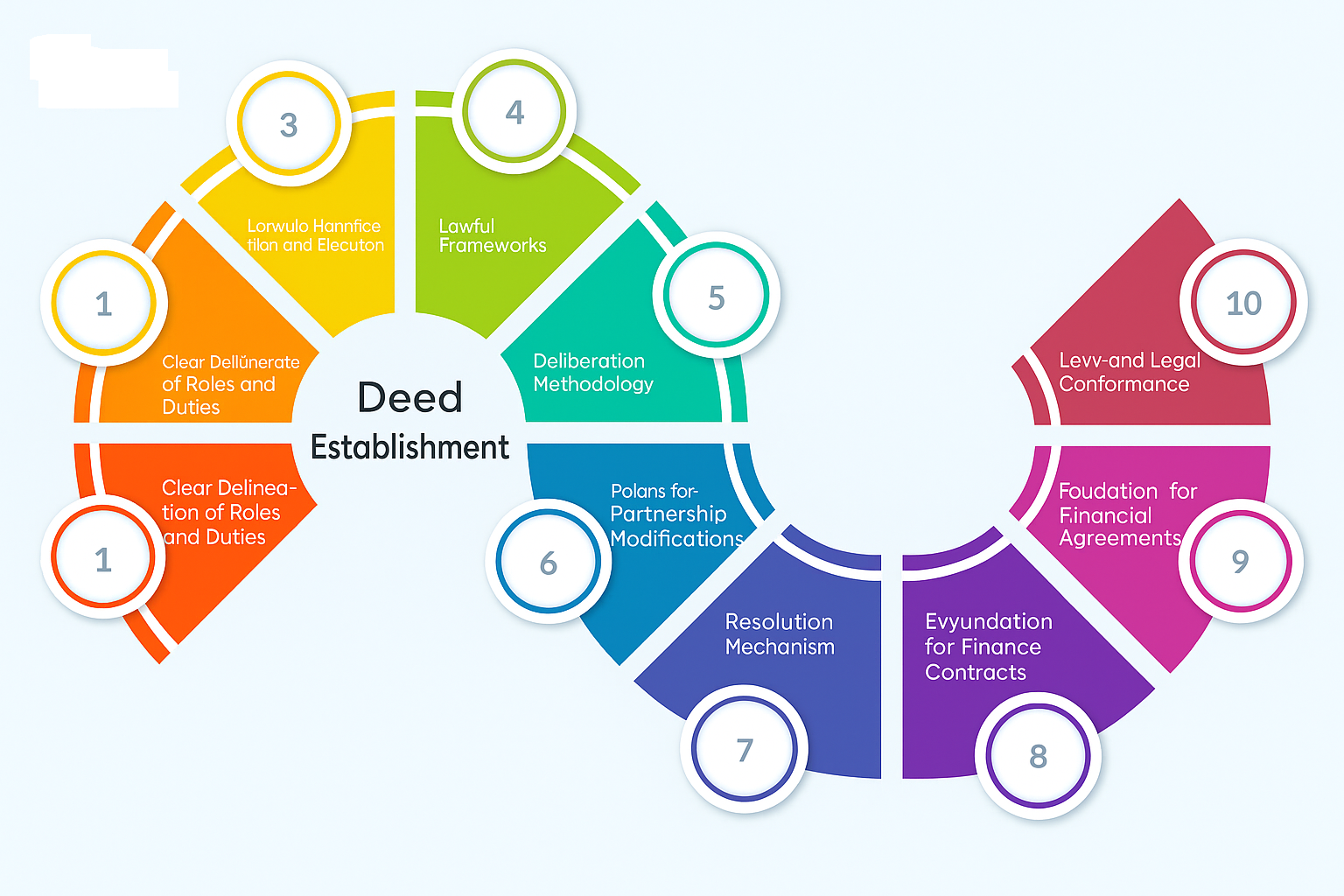

Benefits of Deed Creation

- Clear Definition of Roles and Responsibilities: A partnership deed precisely delineates the specific roles, responsibilities, and duties of each partner. This clarity facilitates efficient management and smooth business operations.

- Prevention of Misunderstandings and Disputes: By meticulously detailing the terms of the partnership agreement, a deed effectively helps avoid misunderstandings and conflicts among partners, serving as a crucial reference for dispute resolution.

- Legal Recognition and Enforcement: A properly written and executed partnership deed holds legal enforceability. This means it can be upheld in a court of law, offering legal protection to partners in instances of disagreements or breaches of the agreement.

- Financial Arrangements: The deed explicitly outlines each partner’s financial contributions, profit-sharing ratios, and other financial provisions. This transparency fosters trust among partners and promotes equitable financial practices.

- Decision-Making Process: By specifying the decision-making framework, the deed ensures that business decisions are made efficiently and democratically, respecting all partners’ perspectives.

- Provisions for Changes in Partnership: The deed can incorporate clauses for admitting new partners, managing the exit of existing partners, and other alterations to the partnership structure. This flexibility is vital for adapting to the evolving nature of business.

- Dissolution Process: In the event that the partnership needs to be dissolved, the deed clearly outlines the dissolution procedure, ensuring a systematic winding up of the business affairs.

- Succession Planning: The deed can include terms addressing a partner’s death or incapacity, providing clarity and continuity for the remaining partners.

- Basis for Financial Agreements: Banks and financial institutions frequently require a partnership deed to understand the business’s structure before extending credit or loans.

- Taxation and Legal Compliance: A partnership deed aids in maintaining transparent records for taxation and legal compliance, as it meticulously details the financial and operational aspects of the business.

Whether partnership deed is required to get registered and its benefits:

Optional Registration:

Under the Indian Partnership Act, 1932, registration of a partnership firm is optional. Partners may choose to register their deed with the Registrar of Firms.

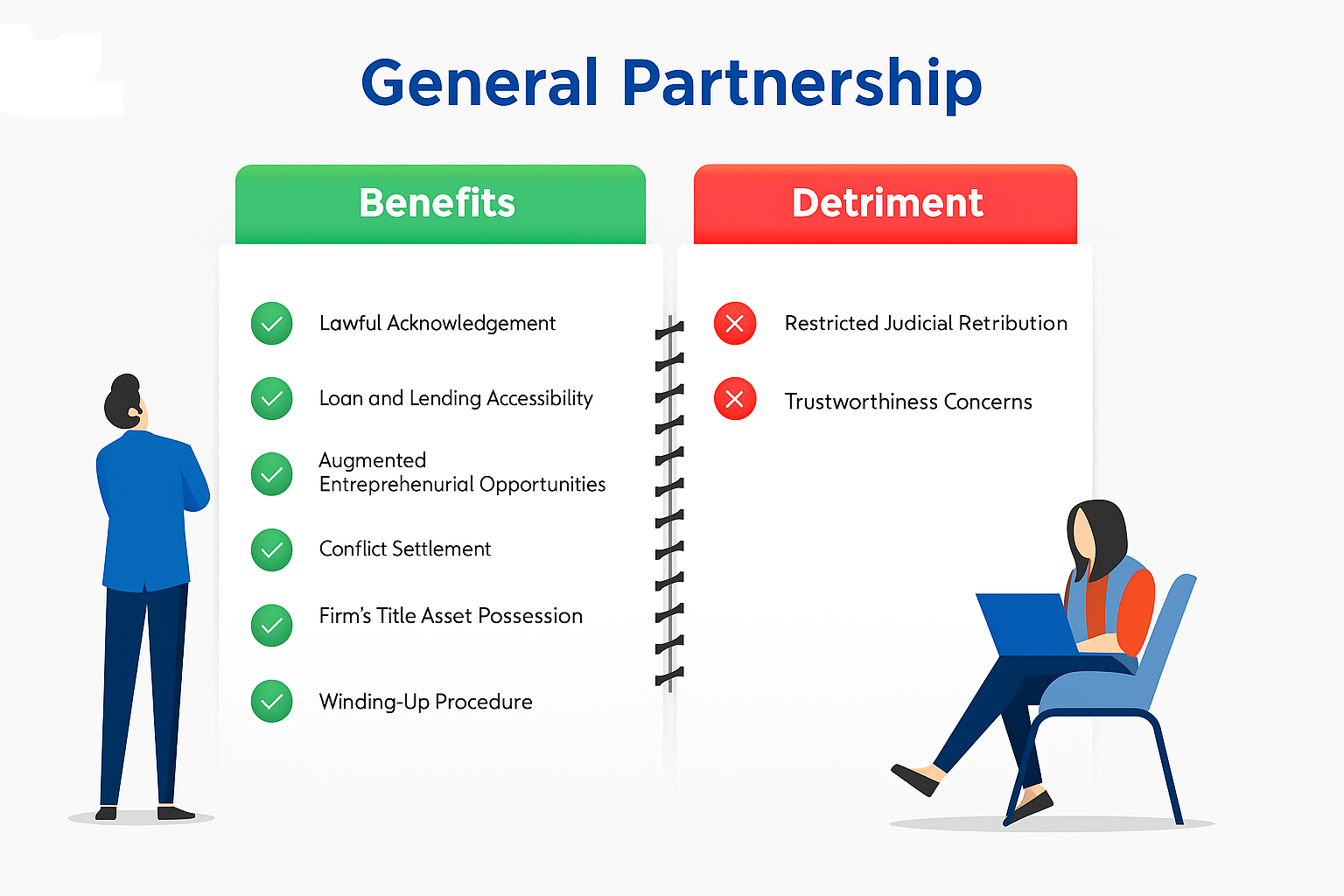

Benefits of Partnership Deed Registration

Legal Recognition: A registered partnership gains legal recognition. This offers an advantage in legal proceedings, allowing a registered firm to formally pursue lawsuits against third parties or partners.

Easier to Obtain Loans and Credit: Financial institutions typically favor dealing with registered entities. Registration can enhance credibility, facilitating easier access to business loans and lines of credit.

Improved Business Opportunities: Many corporations and government bodies prefer to engage with registered businesses. This registration can unlock a wider range of business opportunities.

Dispute Resolution: Registered partnerships possess a clearer legal standing in disagreements among partners or with external parties, making the terms of the partnership deed more enforceable.

Property Ownership in the Firm’s Name: A registered partnership has the capacity to hold property directly in the firm’s name. This is not feasible for an unregistered partnership, where property must be held under the names of individual partners.

Dissolution Process: The procedure for dissolving a registered partnership is more streamlined, with well-defined legal guidelines to follow.

Drawbacks of Not Registering

- Limited Legal Recourse: An unregistered partnership firm lacks the legal standing to initiate court action against any partner or third party to enforce rights stemming from a contract.

- Potential Trust Issues: Unregistered firms may encounter trust deficiencies from stakeholders due to the absence of formal recognition and legal backing.

General Partnership Deed Format

This Deed of Partnership is made on this [Day] day of [Month], [Year] by and between:

- Partner 1: [Full Name], residing at [Address], hereinafter referred to as the “First Party/Partner,”

- Partner 2: [Full Name], residing at [Address], hereinafter referred to as the “Second Party/Partner,”

[Include additional partners as necessary]

Collectively referred to as the “Partners.”

WHEREAS the parties hereto have decided to form a partnership firm under the name and style of [Firm Name] at [Firm Address], and

WHEREAS the parties are desirous of recording the terms and conditions of their partnership.

NOW THEREFORE THIS DEED WITNESSES AS UNDER:

- Name and Nature of Business: The name of the partnership firm shall be [Firm Name], and the nature of the business shall be [Describe Business Nature].

- Commencement and Duration: The partnership shall commence from [Start Date] and shall continue until dissolved by mutual consent.

- Capital Contribution: The capital of the partnership shall be contributed by the partners as follows: [Detail each partner’s capital contribution].

- Profit and Loss Sharing: Profits and losses of the firm shall be shared among the partners in the following ratio: [Specify Profit and Loss Sharing Ratio].

- Bank Account: The bank account of the firm shall be operated in the name of the firm by [Specify Who Will Operate the Account].

- Management and Decision Making: All decisions regarding the business shall be made by mutual consent of the partners.

- Duties and Obligations of Partners: [Detail the specific duties and obligations of each partner].

- Admission and Withdrawal of Partners: The procedure for admission or withdrawal of partners shall be as follows: [Specify Procedure].

- Dissolution: The partnership may be dissolved at any time by mutual consent of all partners, and the assets of the firm shall be used first to pay off the debts of the firm.

- Dispute Resolution: Any disputes arising out of the partnership shall be resolved through arbitration.

- Amendment: This deed can be amended only with the written consent of all partners.

IN WITNESS WHEREOF, the parties hereto have set their hands on this Deed on the day and year first above written.

[Signatures of All Partners]

Witnessed by:

- [Witness #1 Name and Signature]

- [Witness #2 Name and Signature]

FAQs

What is a partnership deed?

A partnership deed is a legal document outlining the rights, responsibilities, and obligations of partners in a business. It serves as the foundation for the partnership’s operations and helps prevent potential disputes.

Is a partnership deed mandatory?

While not legally mandatory in India, having a written partnership deed is highly recommended. It ensures clarity in business operations, defines terms, and provides legal protection for all partners.

What information should be included in a partnership deed?

A partnership deed typically includes details like the firm’s and partners’ names and addresses, nature of business, capital contributions, profit/loss sharing ratios, and dispute resolution mechanisms. It also covers duties, admission/retirement of partners, and dissolution terms.

Can a partnership agreement be oral?

Yes, a partnership agreement can be oral, but a written deed is strongly advisable for legal and tax purposes. A written document acts as a formal record, helping to prevent future misunderstandings and legal complications.

Can a partnership deed be modified?

Yes, a partnership deed can be modified or amended. Any changes require the mutual consent of all partners, and the amended deed should ideally be registered with the Registrar of Firms.

Is registration of a partnership deed compulsory?

Registration of a partnership deed is not compulsory in India but is highly recommended. A registered firm gains legal recognition and the ability to enforce rights in court, such as suing other parties.

What happens if there is no partnership deed?

In the absence of a written partnership deed, the partnership will be governed by the default provisions of the Indian Partnership Act, 1932. This means profits and losses are shared equally, and partners are generally not entitled to a salary or interest on capital.