Page Contents

ToggleProprietorship Firm Registration In India

If you’re looking to launch your business swiftly and with minimal legal obligations, a Proprietorship Firm is an ideal solution. We streamline the online registration process for proprietorship firms across India, ensuring it’s hassle-free. Our service handles all the necessary steps for registering your Sole Proprietorship Firm, allowing you to dedicate your time and energy to expanding your business.

Get Free Consultation by Expert

Proprietorship Firm Registration in India

A Proprietorship Firm, also known as a sole proprietorship, represents the most straightforward and common form of business ownership in India. It’s an unincorporated business exclusively owned and managed by one person, meaning the owner and the business are legally indistinguishable. This structure is favored by self-employed contractors, consultants, and small business operators due to its simplicity, ease of establishment, and low cost.

The defining feature of a proprietorship is its single ownership, where the individual owner assumes all profits, responsibilities, and liabilities. Setting up this type of firm is generally uncomplicated, requiring minimal legal formalities. Similarly, discontinuing the business is less complex than with other business structures. Crucially, a proprietorship is not a distinct legal entity from its owner, implying the business cannot independently engage in legal contracts, own assets, or participate in lawsuits. For those aiming to establish such a business, Tax2Fin offers a streamlined online registration process for Sole Proprietorship in India, ensuring convenience and efficiency.

A proprietorship firm is perfect for individuals seeking complete control over their venture with minimal regulatory obstacles. However, potential owners must weigh the risks associated with unlimited personal liability and the difficulties in raising capital. This business form is best suited for small-scale ventures where the owner is comfortable with their personal and business finances and risks being intertwined. Tax2Fin ensures a seamless registration of your Sole Proprietorship Firm, managing all government requirements and guaranteeing prompt delivery of your registration certificate. Contact Tax2Fin for efficient online proprietorship firm registration in India.

Process of Proprietorship Firm Registration

Choose Your Business Name

Start by selecting a unique name for your business. It's crucial to ensure this name doesn't already exist as a trademark and complies with all local regulations.

Secure Your PAN Card

If you don't already have one, you'll need to apply for a Permanent Account Number (PAN) card in your personal name. Since a proprietorship firm and its owner are legally the same, your personal PAN will be used for all business-related transactions.

Open a Business Bank Account

The next step is to open a current bank account specifically for your business. Banks will typically request proof of your business's existence, such as any registration certificates, to facilitate the account opening.

Register Under Shop and Establishment Act (If Applicable)

If your business operates from a physical shop or a commercial establishment, you must register under the Shop and Establishment Act. This act governs working conditions and employee rights in the unorganized sector. Be aware that the registration process and requirements can differ from state to state.

Obtain GST Registration (If Required)

You'll need to register for Goods and Services Tax (GST) if your annual turnover exceeds the current exemption limits (₹20 lakhs for services and ₹40 lakhs for goods, subject to government changes) or if you engage in inter-state supply of goods and services. This involves submitting various documents and completing the registration on the GST portal.

Consider Additional Registrations and Licenses

Depending on the nature of your business, you might also need several specific licenses or registrations. For instance, a FSSAI License is essential if your business operates within the food sector. If you plan to import or export goods, an IEC Code will be required. Professional Tax Registration is applicable to certain professionals and trades, varying by state. Lastly, Udyog Aadhaar Registration (MSME) is a voluntary option that provides access to various benefits designated for micro, small, and medium enterprises.

Comply with Local Authorities

Always check with your local municipal corporation or panchayat to determine if any additional registrations or compliances are necessary based on your business's location and type.

Maintain Thorough Financial Records

Even though a proprietorship doesn't typically require formal financial audits, keeping precise and well-organized financial records is vital. This is crucial for accurate tax reporting and effective business management.

Fulfill Tax Registrations and Filings

As the business owner, you are responsible for adhering to all tax regulations. This includes timely filing of income tax returns, GST returns (if registered), and any other relevant tax compliances.

Consider Professional Assistance

It can be highly advantageous to engage an accountant or a legal consultant. These professionals can provide valuable support in setting up and maintaining your business, especially with tax filings and ensuring compliance with various legal requirements.

Documents Required for Proprietorship Firm Registration

Director and Shareholder PAN Cards

For all proposed Directors, you'll need their PAN Card. For all Indian Shareholders and Directors, both their PAN and Aadhaar Cards are required.

Business Address Verification

If the business property is owned, provide a copy of the Registry and the latest government electricity bill. If the property is rented, you'll need the Rent Agreement, the latest government electricity bill, and a No-Objection Certificate (NOC) from the landlord.

Additional Director Documents

Each proposed Director must submit a utility bill, telephone bill, mobile bill, or bank statement that is no older than two months as proof of address. You'll also need their mail ID and mobile number, along with the Draft Articles of Association and Draft Memorandum of Association.

Photographs and ID

Finally, you'll need latest passport-sized photographs of all proposed Directors, along with their Aadhaar Card or Passport for identification.

Mail ID and Mobile number

Mail ID and Mobile number of proposed Director along with Draft Articles of Association and Draft Memorandum of Association.

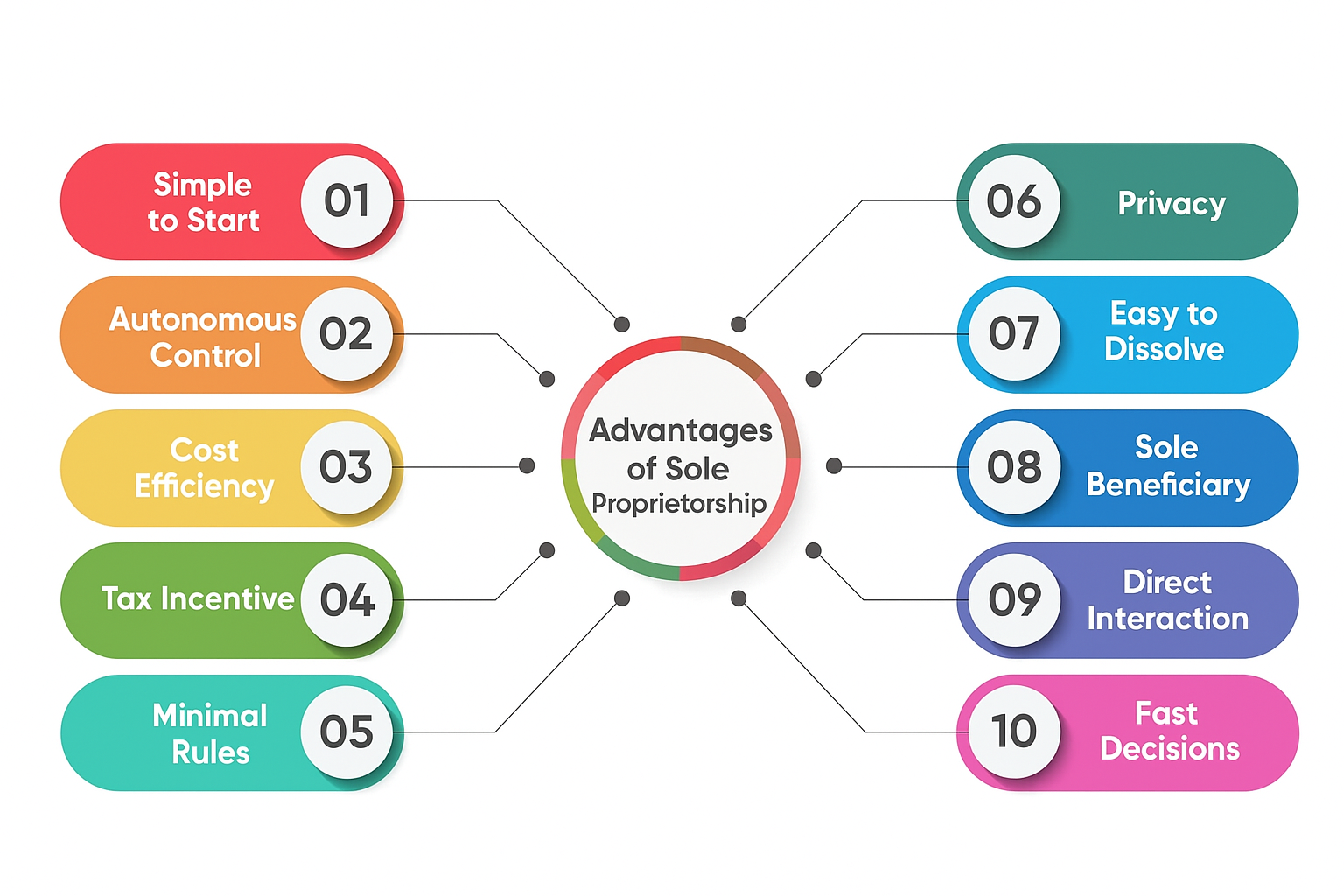

Advantages of Proprietorship Firm Registration

Simple and Easy to Establish

A significant benefit of a proprietorship firm is its straightforward setup process. It involves minimal legal formalities and a simple registration, making it one of the easiest business forms to get started. This simplicity also extends to its ongoing management and compliance requirements, which are generally less burdensome compared to corporations or partnerships. For individuals looking to start a business, registering a Proprietorship Firm in India offers a very streamlined path.

Complete Control

As the sole owner, the proprietor holds complete authority over all business decisions. This high level of autonomy enables rapid decision-making and offers great flexibility, allowing the business to quickly adapt to evolving market conditions or customer demands.

Lower Formation and Operational Costs

Proprietorships typically involve lower initial setup costs compared to other business structures. Furthermore, ongoing operational expenses are reduced due to fewer regulatory obligations and lower compliance costs.

Tax Benefits

In a proprietorship, the business's income is considered the owner's personal income. This means it is taxed only once, thereby avoiding the potential for double taxation that can occur in certain other business entities like corporations. Additionally, proprietors can often leverage specific tax deductions to lower their taxable income.

Minimal Compliance Requirements

Proprietorships generally face fewer government regulations and rules. The requirements for reporting, bookkeeping, and audits are less stringent compared to corporations, making it easier to meet legal obligations.

Confidentiality

Since the proprietor is the sole decision-maker, strategic business decisions and detailed financial performance can be kept private. This level of confidentiality might not be possible in a corporation, where shareholders typically have a right to this information.

Ease of Dissolution

Just as it is simple to establish, a proprietorship can also be easily dissolved. The process is straightforward and avoids complex legal procedures, which is advantageous if the owner decides to cease business operations.

Direct Benefit of Efforts

The proprietor directly enjoys the full rewards of the business's success. Unlike corporations or partnerships where profits are distributed among shareholders or partners, the sole proprietor receives the entirety of the profits from their labor and efforts.

Personal Touch

Proprietorships often excel in customer service and business relationships due to the personal involvement of the owner. This direct engagement can foster stronger customer loyalty and lead to more personalized service.

Streamlined Decision Making

Without the need to consult with partners or a board of directors, decision-making in a proprietorship is quick and efficient. This allows for greater agility and streamlined operations within the business.

Compliances to be done by the Proprietorship Entity

GST Compliance

If your business is registered under GST, you will have specific ongoing responsibilities. You must file GST returns either monthly, quarterly, or annually, based on your registration type and turnover. It is also crucial to maintain proper invoices that adhere to GST regulations. Furthermore, you need to keep accurate track of your Input Tax Credit and ensure it is utilized correctly.

Income Tax Compliance

As a proprietor, you are required to file annual income tax returns, with the business income being taxed as your personal income. If your tax liability for a financial year is projected to be more than ₹10,000, you must pay advance tax in four installments. Additionally, you need to comply with TDS (Tax Deducted at Source) regulations where applicable.

Professional Tax Compliance

If Professional Tax is applicable in your state (levied by state governments on income from professions or employment), you must ensure compliance, which involves making periodic payments and filing returns as per state-specific regulations.

Shop and Establishment Act Compliance

If your business is registered under the Shop and Establishment Act, you must adhere to its provisions. This typically includes maintaining specific records, complying with prescribed working hours, providing weekly holidays, and managing leave policies for your employees. Requirements vary by state.

Licenses Renewal

It is crucial to ensure the timely renewal of all applicable business licenses and registrations. This includes specific licenses like the FSSAI (Food Safety and Standards Authority of India) license for food businesses and the Import Export Code (IEC) for businesses involved in international trade.

Record Keeping

While proprietorships are not legally mandated to undergo formal financial audits unless specific turnover thresholds are met (e.g., turnover exceeding ₹1 crore for businesses or gross receipts exceeding ₹50 lakh for professionals may trigger a tax audit), maintaining comprehensive and accurate books of accounts is vital. Good record-keeping is essential for tax purposes, effective business management, and in case of any audits by tax authorities.

Compliance with Labour Laws

If your proprietorship employs workers, you must comply with relevant labour laws. This includes adhering to minimum wage regulations, contributing to provident fund (PF) and Employees' State Insurance (ESI) schemes if applicable, and complying with gratuity and other employee welfare provisions. Key laws include the Minimum Wages Act, Payment of Wages Act, and Employees' State Insurance Act.

Annual Compliances

Unlike companies, proprietorships are not required to file annual returns with the Ministry of Corporate Affairs (MCA). However, it is highly advisable to prepare and maintain annual financial statements, such as a balance sheet and profit and loss account, for internal management, financial analysis, and tax purposes.

Other Sector-Specific Compliances

Depending on the specific industry or sector your business operates in, there might be additional regulatory compliances. Examples include obtaining environmental clearances for manufacturing units or adhering to stringent safety regulations for businesses handling hazardous materials.

Insurance

It is highly recommended to consider obtaining relevant business insurance policies. This can help mitigate various risks associated with business operations, such as commercial general liability, property insurance, workers' compensation insurance (if applicable), and professional liability insurance, protecting your business from unforeseen financial burdens.

How Tax2Fin helps you in the Proprietorship Firm Registration Process?

We are committed to providing comprehensive support to our clients. You will be assigned a dedicated personal manager who will guide you through the entire process of registering your Proprietorship Firm in India. Our team will assist you at every stage, ensuring that all necessary registrations for your proprietorship firm are completed efficiently and within a reasonable timeframe, provided you supply the required documents and information promptly.

Steps to be taken care of Post Registration of the LLP

KYC of the Proprietor

The first crucial step involves arranging all the Know Your Customer (KYC) documents for the individual who will be the proprietor of the business. These documents are essential for verifying the identity and address of the sole owner.

Identity & Address Proof

Specifically, you will need to gather valid identity proof and address proof for the proprietor. Common examples include a PAN card, Aadhaar card, voter ID, passport, driving license, and utility bills (electricity, water, gas) or bank statements for address verification.

Udyog Aadhaar/MSME Compliance

It is highly recommended to obtain the Udyog Aadhaar registration for your proprietorship firm. This is a straightforward process that can be completed online and helps in identifying your business as a Micro, Small, or Medium Enterprise (MSME), which can unlock various government benefits and schemes.

Business Registration Number (BRN)

You'll need to acquire the Business Registration Number (BRN) for your proprietorship firm. This is also a relatively simple online process. The BRN serves as a unique identifier for your business in various official contexts.

Opening and Operating a Bank Account

Once your proprietorship firm is officially registered, a crucial step is to open a current bank account specifically in the name of the business. This is vital for maintaining a clear distinction between your personal and business finances, simplifying accounting, and ensuring financial transparency for your operations.

FAQs

What is a Proprietorship Firm?

A Proprietorship Firm is a business run entirely by one person. It’s the simplest business structure, where the owner has full control, and there’s no legal separation between the owner and the business itself. Registering a Proprietorship Firm in India is a direct way to establish a legally recognized business.

How is a Proprietorship Firm registered in India?

In India, there isn’t a specific formal registration for sole proprietorships. However, the owner might need to get various business-specific licenses, such as GST registration or a Shop and Establishment Act license. Services for Proprietorship Firm Registration can help manage these necessary licenses and registrations effectively.

What are the key advantages of a Proprietorship Firm?

The main benefits of registering a Proprietorship Firm include its simple setup and operation, the owner’s complete control, minimal compliance obligations, and tax advantages since the business income is treated as the owner’s personal income for tax purposes.

Are there any disadvantages to a Proprietorship Firm?

The primary drawbacks of a Proprietorship Firm are the owner’s unlimited personal liability, challenges in securing capital, and the lack of business continuity if the owner passes away or becomes incapacitated.

How is a Proprietorship Firm taxed in India?

In India, the income generated by a proprietorship firm is taxed as the owner’s personal income. The proprietor pays income tax according to the individual tax slabs and is required to file an income tax return each year.

Is it mandatory to have a separate bank account for a Proprietorship Firm?

Although it’s not legally required, it’s strongly advised to have a separate bank account for all business transactions. This practice ensures clear financial records and simplifies accounting processes for the proprietorship.