Page Contents

ToggleGift Deed Format

Before you give a gift to your loved ones, it’s important to make sure you’re complying with all relevant tax regulations. The Tax2Fin Team is here to help you understand and meet your Gift Tax obligations, so you can share your generosity without worry. Your peace of mind and financial compliance are our top priorities.

With Tax2Fin’s Gift Tax Assistance, you get:

Expert advice on current Gift Tax rules and exemptions

Guidance on documenting and reporting gifts properly

Personalized strategies to minimize your tax liability legally

Full compliance with Indian tax laws and regulations

Transparent, affordable pricing with no hidden charges

Get Free Consultation by Expert

Gift Deed

A Gift Deed is a legal instrument facilitating the transfer of property or assets from one individual (the donor) to another (the donee) without any monetary exchange or consideration. These deeds are commonly employed for various purposes, including the gratuitous transfer of property, assets, or valuables to family members, friends, or charitable organizations.

Key Differences

Gift deeds can apply to both movable and immovable property, with the primary difference being the nature of the asset transferred:

- Movable Property Gift Deed: Movable property consists of items that are physically transportable, such as jewelry, vehicles, furniture, cash, stocks, and other personal possessions. When movable property is gifted, a gift deed is still utilized to transfer ownership from the donor to the recipient. This deed typically includes details about the donor, done, a description of the property, and any applicable conditions or restrictions.

- Immovable Property Gift Deed: Immovable property refers to land, buildings, and real estate that cannot be easily relocated. These are generally larger assets, encompassing plots of land, houses, commercial properties, and agricultural land. When gifting immovable property, a gift deed is essential and, in most legal systems, must be in writing and registered with the appropriate government authority or land registry. The specific requirements and procedures for registering such a deed can vary by jurisdiction. The immovable property gift deed should detail the donor, donee, a precise description of the property (including its exact location, size, and boundaries), and any relevant conditions, restrictions, or considerations. In many nations, including India, immovable property gift deeds may incur stamp duty, a government tax on property transactions, with the amount based on the property’s value and local regulations.

Taxability of Gift Deeds

- In India, gifts received from relatives, as defined by the Income Tax Act (including parents, siblings, spouses, and others), are generally exempt from income tax.

- Gifts received from non-relatives are subject to income tax if their total value in a financial year surpasses a specified limit of ₹50,000. Any amount exceeding this threshold may be added to the recipient’s taxable income.

- Additionally, gifts of immovable property (like land or real estate) may also incur stamp duty, with the applicable rates varying by state.

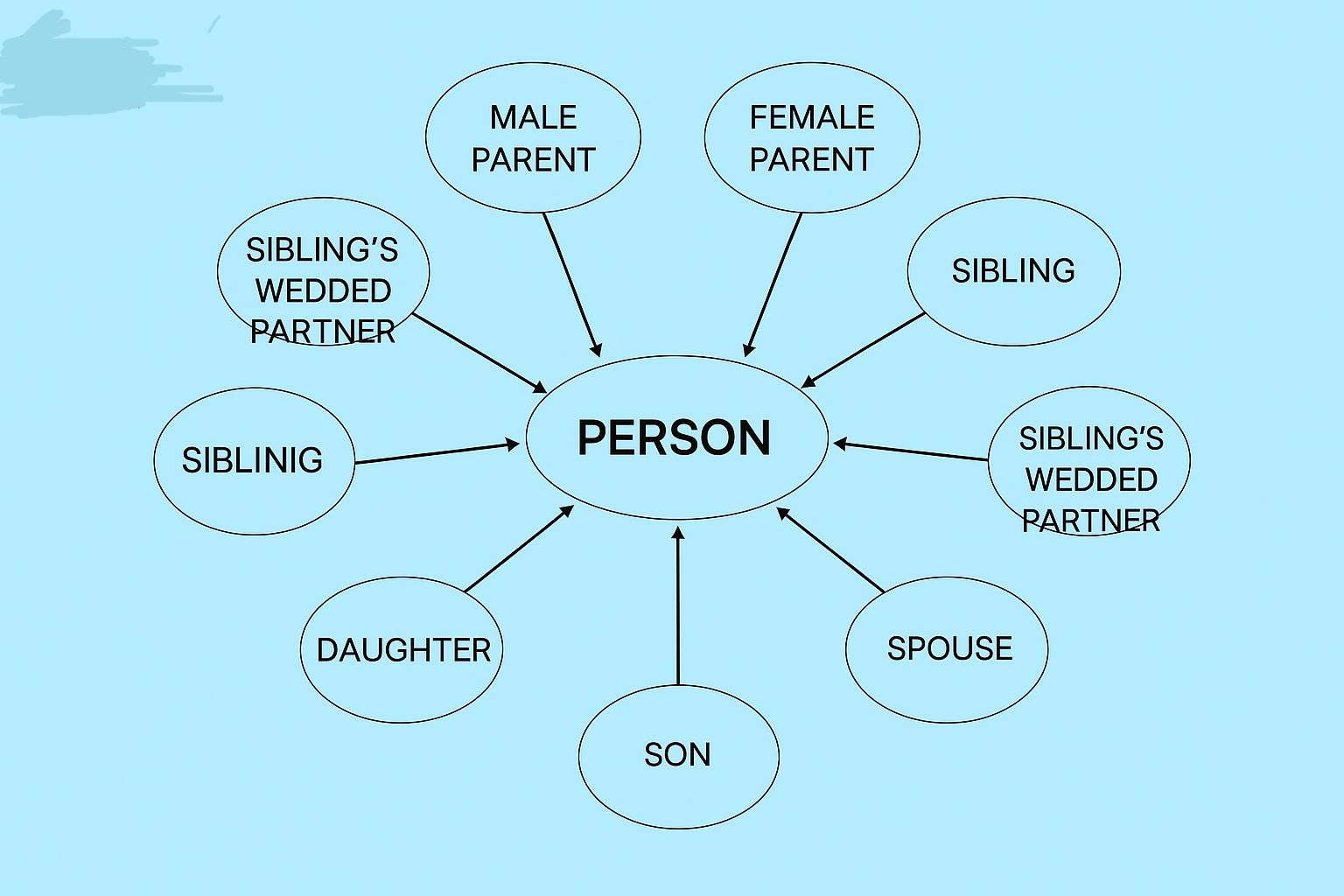

Chart of Relative as per Income Tax Act 1961

General Gift Deed Format

THIS DEED OF GIFT is made on this [Day] day of [Month], [Year] between:

Donor: [Donor’s Full Name], [Donor’s Address], hereinafter referred to as the “Donor” (which expression shall, unless repugnant to the context, include their heirs, representatives, and assigns) of the ONE PART,

AND

Donee: [Donee’s Full Name], [Donee’s Address], hereinafter referred to as the “Donee” (which expression shall, unless repugnant to the context, include their heirs, representatives, and assigns) of the OTHER PART.

WHEREAS the Donor is absolutely seized and possessed of or otherwise well and sufficiently entitled to the property more particularly described in the Schedule hereunder written.

AND WHEREAS the Donor is desirous of gifting the said property to the Donee out of natural love and affection which he bears towards the Donee.

NOW THIS DEED WITNESSETH AS FOLLOWS:

- Gift: The Donor does hereby freely and voluntarily and out of natural love and affection, give, transfer, and assign unto the Donee, the property more particularly described in the Schedule hereunder written, to hold the same unto the Donee absolutely and forever.

- Acceptance: The Donee hereby accepts the gift and takes possession of the said property.

- Transfer of Property: The Donor declares that the said property is free from any encumbrances, charges, liens, or liabilities whatsoever.

- Covenants of the Donor: The Donor covenants with the Donee that notwithstanding any act, deed, matter, or thing whatsoever made, done, or executed to the contrary, the Donor now has in himself/herself good right, full power, and absolute authority to gift the said property in the manner aforesaid.

- Indemnity: The Donor hereby agrees to indemnify the Donee against all claims and demands in respect of the said property.

SCHEDULE OF THE PROPERTY

[Provide a detailed description of the property being gifted]

IN WITNESS WHEREOF, the Donor and the Donee have hereunto set their hands and seals the day and year first above written.

SIGNED, SEALED, AND DELIVERED by the Donor

[Donor’s Name & Signature]

in the presence of:

[Name & Signature of Witness #1]

[Address of Witness #1]

[Name & Signature of Witness #2]

[Address of Witness #2]

SIGNED, SEALED, AND DELIVERED by the Donee

[Donee’s Name & Signature]

in the presence of:

[Name & Signature of Witness #1]

[Address of Witness #1]

[Name & Signature of Witness #2]

[Address of Witness #2]

FAQs

What is a Gift Deed?

A Gift Deed is a legal document used to voluntarily transfer ownership of property (movable or immovable) from one person (the donor) to another (the donee) without any monetary consideration. It establishes legal ownership for the recipient immediately upon registration.

What properties can be transferred through a Gift Deed?

Both immovable properties like land, houses, and apartments, and movable properties such as jewellery, vehicles, or cash, can be transferred. The donor must have clear, legal ownership, and the transfer must be immediate and tangible.

Is registration of a Gift Deed mandatory?

Yes, for immovable property, registration of a Gift Deed is mandatory under the Indian Registration Act, 1908, to be legally valid. For movable property, while not mandatory, registration is still advisable for legal proof.

What are the documents required for Gift Deed registration?

Key documents include identity proofs (Aadhaar, PAN) of both donor and donee, proof of property ownership, and two witnesses with their identity proofs. Additional documents like an Encumbrance Certificate or NOC for agricultural land might be required.

What are the tax implications of a Gift Deed?

Gifts received from specified relatives are tax-exempt regardless of value. Gifts from non-relatives are taxable if the total value exceeds ₹50,000 in a financial year. Stamp duty is also payable, with rates varying by state and relationship between parties.

Can a Gift Deed be revoked or cancelled?

A Gift Deed can be cancelled by mutual agreement between the donor and donee, or if a revocation clause was included in the original deed. It can also be revoked by court if proven to be executed under fraud, coercion, or undue influence.

What is the difference between a Gift Deed and a Will?

A Gift Deed transfers property ownership immediately upon registration during the donor’s lifetime. A Will, however, takes effect only after the testator’s death and can be changed multiple times before then.

Are there any conditions for a valid Gift Deed?

The transfer must be voluntary, without monetary consideration, and the donee must accept the gift during the donor’s lifetime. The property must exist at the time of gifting, and the deed must be signed and attested by two witnesses.