Page Contents

ToggleShare Transfer Agreement

Seeking to transfer shares, especially those not freely traded, from one individual to another? Tax2Fin is here to make the process simple, smooth, and fully compliant. Our team of experts will guide you through every step, ensuring your share transfer is handled efficiently and without unnecessary complications.

With Tax2Fin’s Share Transfer Assistance, you get:

Expert guidance on legal and procedural requirements

Preparation of accurate, customized transfer documentation

Compliance with all applicable company and regulatory laws

Hassle-free processing for restricted or private shares

Get Free Consultation by Expert

Share Transfer Agreement

A Share Transfer Agreement is a formal legal document that governs the transfer of ownership of shares from one party to another. This is especially vital in private limited companies, where shares are not freely traded on the open market and transfers must be carefully documented and approved as per the company’s Articles of Association. The agreement outlines key details such as the identities of the buyer and seller, the number and type of shares being transferred, and the agreed purchase price.

Additionally, it includes payment terms (lump sum or installments), representations and warranties by both parties, conditions precedent (like board approval), and the effective date of transfer. The agreement also ensures compliance with Companies Act, 2013, and helps avoid future disputes by clearly defining the rights and obligations of both parties. Often accompanied by share transfer forms and board resolutions, the Share Transfer Agreement provides a legal safeguard for transparent and valid ownership transition.

Key Aspects of the Agreement

- Title and Introduction: This initial section designates the document as a Share Transfer Agreement and usually states the date and location where the agreement is formally established.

- Parties Involved: Explicitly identify the full names and addresses of both the seller (transferor) and the buyer (transferee) of the shares.

- Recitals: This part offers essential background and contextual information, clarifying the underlying reasons or rationale for the share transfer.

- Definitions and Interpretations: Crucial terms utilized throughout the agreement are precisely defined to ensure clarity and eliminate any potential ambiguities.

- Details of the Shares: Specify the exact quantity and class of shares undergoing transfer, including any unique identifying numbers or certificate details.

- Transfer Price and Payment Terms: Clearly outline the mutually agreed-upon price for the shares and the specific payment terms, encompassing the payment method, schedule, and any associated conditions or contingencies.

- Representations and Warranties: Both the selling and buying parties provide formal assurances regarding the status of the shares, adherence to legal requirements, confirmation of no existing encumbrances, and other relevant guarantees.

- Covenants: This section contains legally binding promises made by the parties concerning their actions and conduct related to the share transfer.

- Conditions Precedent: List any specific requirements or events that must be fulfilled before the share transfer can become legally effective.

- Indemnification: Include provisions detailing how each party will compensate the other for any losses that may arise from breaches of the agreement or false representations.

- Confidentiality: Clauses are incorporated to ensure that any sensitive or proprietary information exchanged during the transaction remains private.

- Termination: Clearly specify the circumstances and methods by which the agreement can be formally ended.

- Dispute Resolution: Detail the agreed-upon process for resolving any disagreements or disputes that may arise, such as through arbitration or litigation.

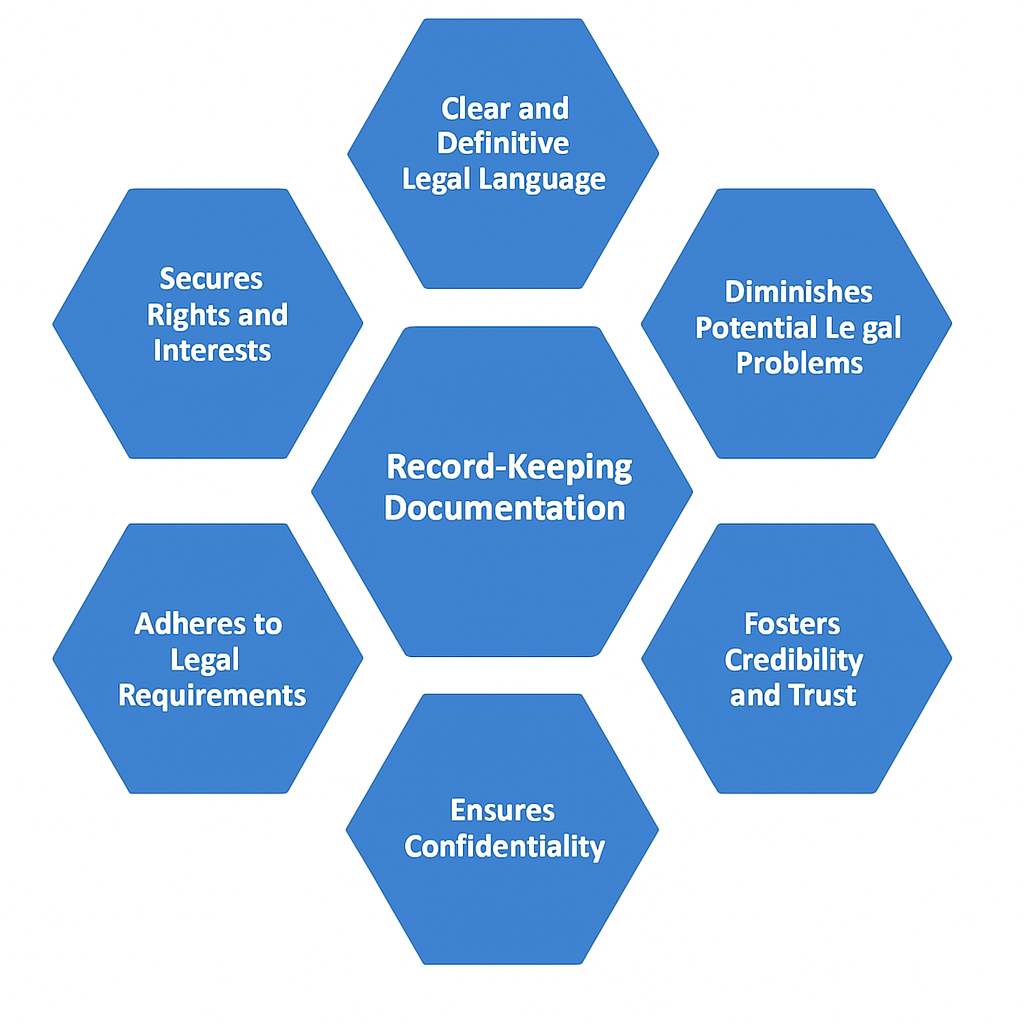

Benefits of Share Transfer Agreement

FAQs

What is share transfer?

Share transfer is the process of changing ownership of shares from one person (the transferor) to another (the transferee). This legally assigns the rights and obligations associated with the shares to the new owner.

Why is share transfer necessary?

Share transfer becomes necessary when shares are bought, sold, gifted, or inherited. It formalizes the change of ownership, ensuring that the new owner is legally recognized and can exercise shareholder rights.

What are the types of share transfer?

Share transfer can occur through two primary methods: physical transfer, involving physical share certificates and transfer deeds, and dematerialized transfer, where shares are held electronically in a Demat account and transferred digitally.

What documents are required for share transfer?

Key documents typically include the share transfer deed, original share certificates (for physical transfer), PAN cards of both parties, and address proof. For dematerialized transfers, Demat account details are essential.

Is stamp duty applicable on share transfer?

Yes, stamp duty is applicable on share transfers as per the Stamp Act. The duty rate varies by state and the consideration involved in the transfer, and it must be paid for the transfer to be legally valid.

What is the process for share transfer?

The general process involves executing a share transfer deed, affixing appropriate stamp duty, submitting the documents to the company/depository participant, and finally, updating the company’s register of members with the new ownership.

Can shares be transferred in physical form?

While electronic transfer is prevalent, shares can still be transferred in physical form, particularly for unlisted companies. This requires submission of physical share certificates along with the duly executed transfer deed.

What is the role of a company secretary in share transfer?

A Company Secretary plays a crucial role in ensuring that share transfers comply with legal and regulatory provisions. They oversee the documentation, verify signatures, and ensure proper recording in the company’s books.